Fast-forward three years, most people

will have 5-10 different CSS business subscriptions. Entrepreneurs are

continuing to build better products, and consumers are seeing value in these

services because they truly make life better. For many of us, the idea of

paying $30 per year to improve one’s life is very appealing."

We believe that the CSS business model

enables companies to rapidly scale with attractive margins while also providing

a compelling consumer value proposition. We are excited to help guide CSS

companies through the next chapter of their evolution.”

ABOUT US

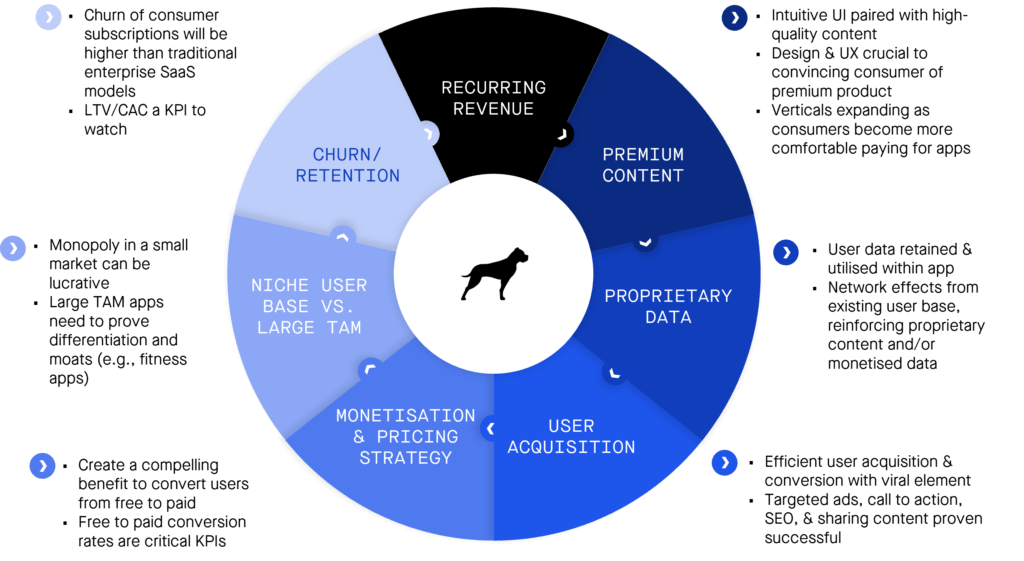

KEY CSS INSIGHTS

A leading technology advisory and

investment firm, providing transaction advisory and capital

Our CSS Index shows private consumer

companies are set to drive lively IPO market

From our CSS flywheel to Western /

Eastern models, here’s what you need to know

Expert views from company builders

What CSS leaders and investors have to

say

Niche end-verticals highlight a

broad landscape

css metrics to watch

What investors focus on and

key nuances

Past CSS insights

The view from GP Bullhound

current css ecosystem

Getting the fundamentals right

market update

Alec dafferner, partner

Eric crowley, executive director

About GP Bullhound’s CSS team

GP

Bullhound’s CSS team

GP Bullhound’s CSS team leverages decades

of

collective experience, proprietary intelligence, deep industry

relationships,

and leading data sources to identify and

communicate what you need to know to stay

ahead of the curve

Our CSS practice is led by our San Francisco-based Executive Director, Eric Crowley, who has 10+ years of investment banking and private equity experience

Click on the authors below to learn more about our team

Our CSS practice is led by our San Francisco-based Executive Director, Eric Crowley, who has 10+ years of investment banking and private equity experience

Click on the authors below to learn more about our team

research team

Alec dafferner

eric crowley

okan inaltay

vice president

executive director

partner

associate

daniel kim, cfa

gerry kelliher

associate

garret vaz

vice president

Daniel roberts

adam segall

analyst

analyst

maria lazareva

research analyst

jennifer eller

vice president, hEAD OF research

Deep

domain expertise in the consumer subscription sector

First investment bank with a CSS focus

Consistently serving as a

contributor and guide to the CSS ecosystem and entrepreneurs

Our recent CSS reports

Click on the images below to read more

Our celebrated news articles

Click on the images below to read more

2020

2019

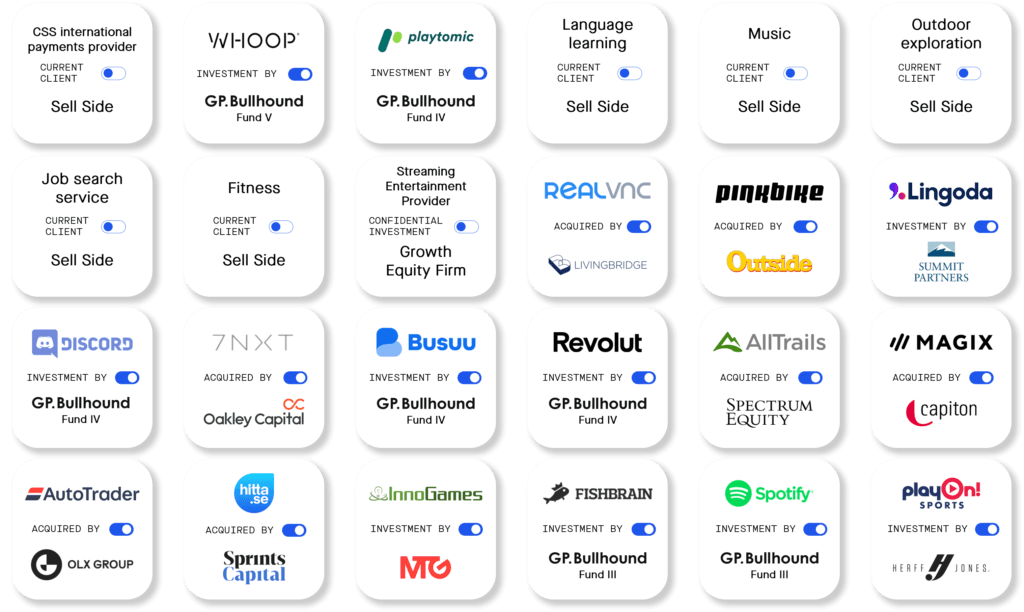

GP

Bullhound’s recent CSS activity

GP Bullhound continues to lead in

the CSS sector from both an advisory and an investment perspective

How

do you stack up?

We want to hear from you - take our CSS survey

Our passion is CSS, and core to GP

Bullhound’s mission, we want to help the world understand the ecosystem’s

nuances and operators

Who?

What?

Where & when?

CSS company owners and investors – as a

part of our market research on the CSS ecosystem, we want to learn more about

your business for benchmarking purposes

Our online survey will take just a few

moments of your time – less than 10 questions

All data will be aggregated and kept

anonymous

We ask all participants to complete our

online survey by 31 October 2021

Once we crunch the numbers, we’ll send you the results!

Once we crunch the numbers, we’ll send you the results!

Market update

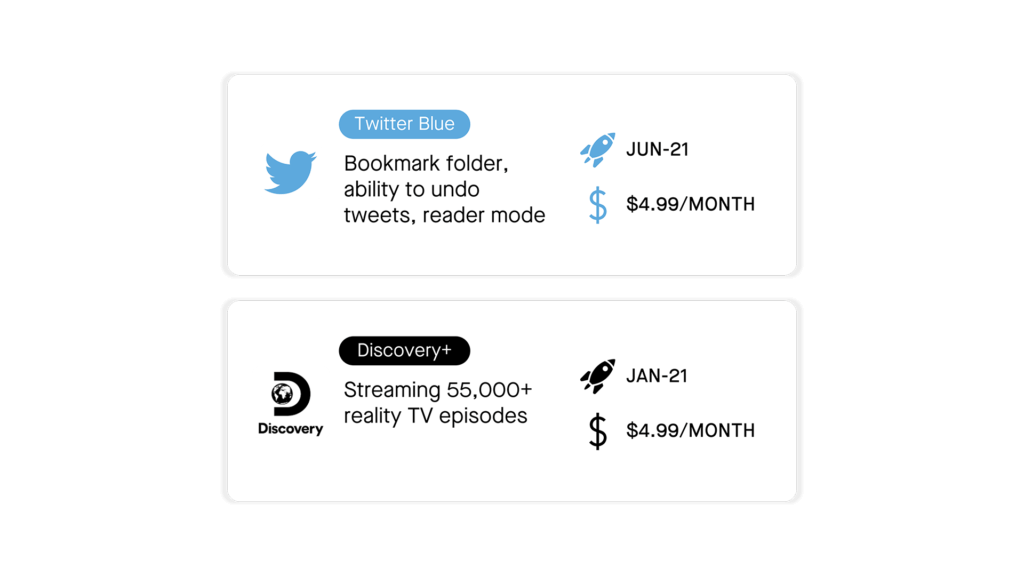

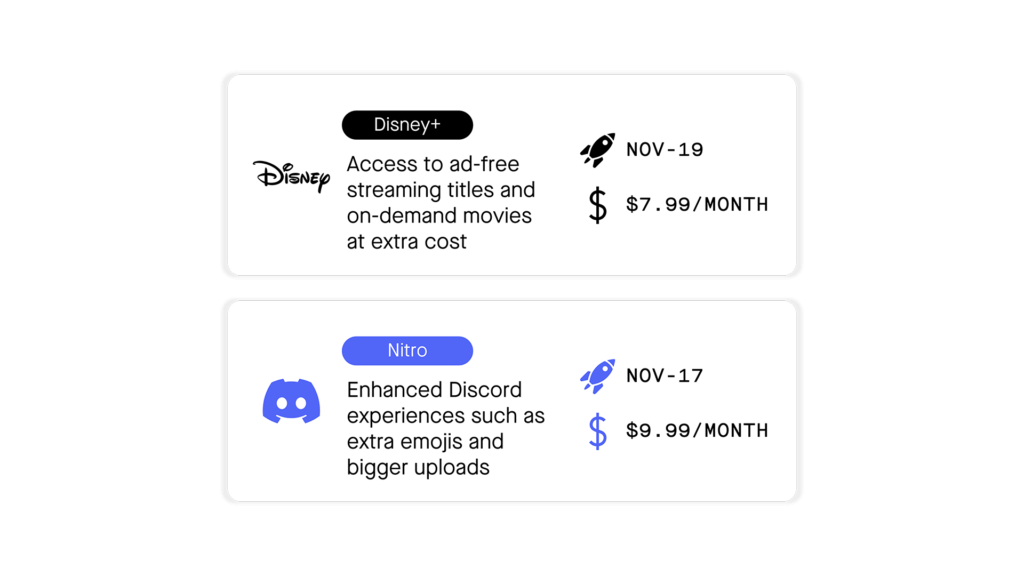

Established consumer brands launch

subscription offerings

Sources: Sensor Tower, DataGrail, Edelman

Trust Barometer, and GP Bullhound insights

Multiple brands have launched subscriptions for their apps and websites to generate recurring revenue and a stickier client base

Apple legal case versus Epic,

and impact on App Store take rates

and impact on App Store take rates

Apple’s App Store legal cases are

beginning to impact App Store take rates

The courtroom battle over Apple Store’s

30% take rate continues to drag on, with both sides presenting compelling

arguments

Increased antitrust pressure on the US

Congress, and in Asian countries and the EU, could see Apple proactively making

changes to avoid court rooms

CSS investors and entrepreneurs could see

billions of dollars swing their way as Apple’s walled garden is showing cracks

Sources: Sensor Tower, DataGrail, Edelman

Trust Barometer, and GP Bullhound insights

Apple recently announced several

compromises for developers, including allowing developers to notify consumers

about alternative payment options (web) over email as well as allowing media

apps to have an in-app link

Expect entrepreneurs to quickly

move to take advantage of web sign-ups or discounted renewals through the web

iOS 14 and impact on industry

growth

Short-term pain = long-term gain

With the release of iOS 14 in September

2020, consumers are asked if apps can collect their data for tracking purposes,

including the Apple IDFA

Consumers also have a dashboard to quickly review all App Store subscriptions

This change is widely expected to reduce consumer targeting efficiency and conversion rates, driving up customer acquisitions costs

Consumers also have a dashboard to quickly review all App Store subscriptions

This change is widely expected to reduce consumer targeting efficiency and conversion rates, driving up customer acquisitions costs

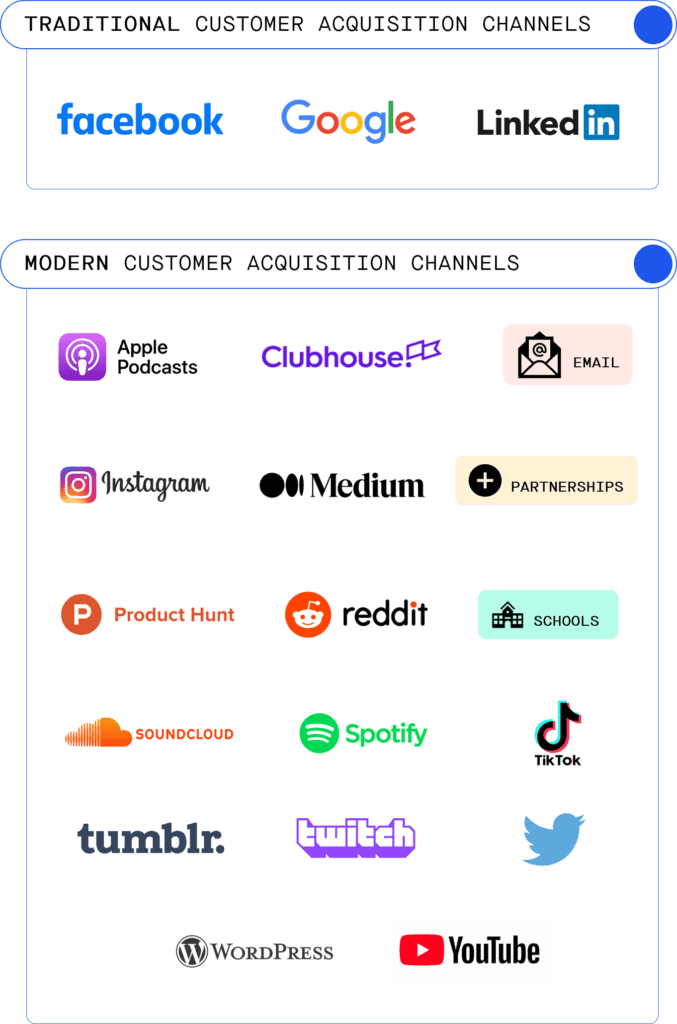

- Early surveys indicate 90-95% of consumers opt out of being tracked, confirming industry fears and hurting ad efficiency across platforms like Facebook

- With Facebook ad personalisation and performance hindered, CSS advertisers will look for other avenues for advertising

- Reduced marketing efficiency to force CSS businesses to focus on acquiring customers organically through clever engineering and unique value propositions

- Combined with the Apple Tax, iOS 14 to push businesses to drive consumers to sign up through web interfaces, improving margins

- App developers are given an additional tool to acquire, retain, and win back subscribers by using an offer code for subscriptions

- The code can be distributed through any digital or offline method, allowing a customer to access an app for free or for a discounted subscription for a specific duration

Short-term: CSS ecosystem growth

hampered by adoption of iOS 14

Long-term: This will benefit the CSS industry by forcing companies to build better products that attract customers organically

Long-term: This will benefit the CSS industry by forcing companies to build better products that attract customers organically

Sources: Sensor Tower, DataGrail, Edelman

Trust Barometer, and GP Bullhound insights

‘Covid bump’ or paradigm shift in

consumer preference?

As developed nations begin to emerge from

the pandemic, many investors are asking if Covid-driven growth rates can be

maintained

Last year’s subscribers have started renewing and investors are

watching for early signals in renewal rates

Based on GP Bullhound’s surveys, the

transition to subscription services will carry on as entrepreneurs continue to

roll out valuable offerings to help consumers improve their everyday lives

Many CSS businesses had a fantastic 2020

as consumers converted in-person activities to digital experiences, including

working out at home, exploring the outdoors, or trying a new hobby

Sources: Sensor Tower, DataGrail, Edelman

Trust Barometer, and GP Bullhound insights

INCREASED DEMAND FOR

HIGH-QUALITY CSS BUSINESSES

HIGH-QUALITY CSS BUSINESSES

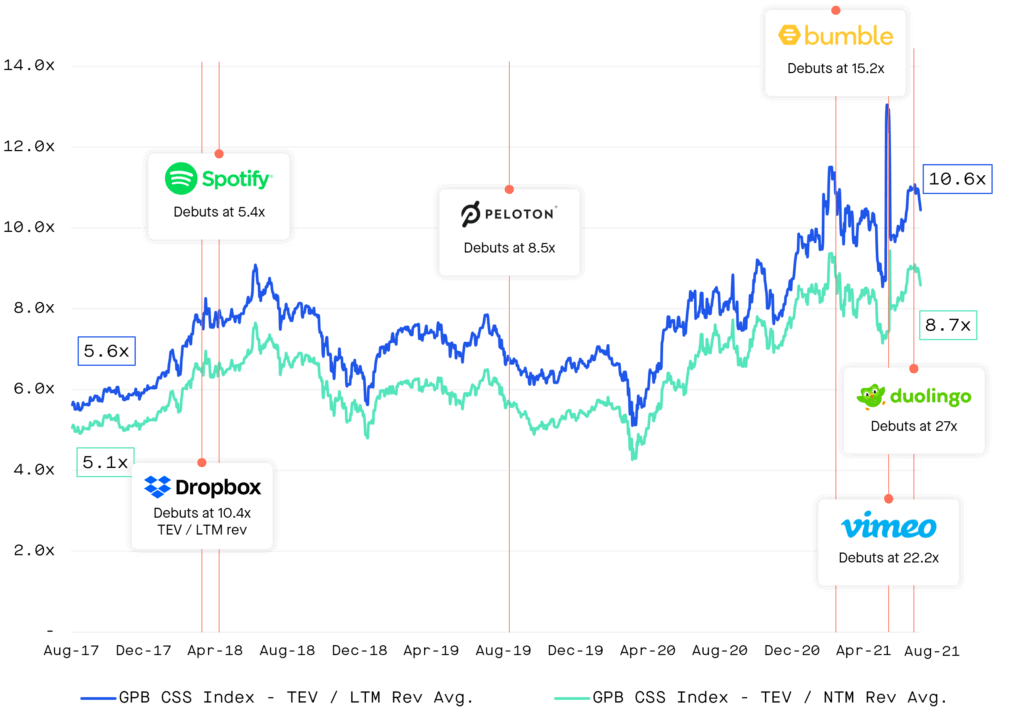

Our

CSS Index shows growing public investor excitement

- 2020: c.43 consumer IPOs

- Airbnb and DoorDash defied the coronavirus economy, saw attractive public valuations

- Private consumer companies followed, making for a lively 2021 IPO market

- Select private CSS companies backed by private equity heavyweights and primed for 2021-2022 IPOs

GP BulLhound's CSS Index

Sources: Sensor Tower, DataGrail, Edelman

Trust Barometer, and GP Bullhound insights

- Our CSS index, the first to track how public CSS investments are valued, includes names such as:

Robust

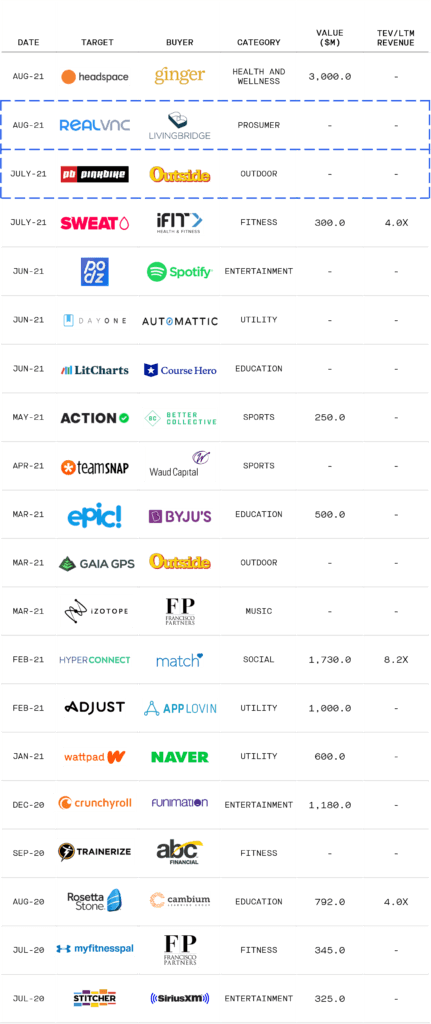

M&A deal activity

Sources: Capital IQ and Pitchbook as of 21 July 2021

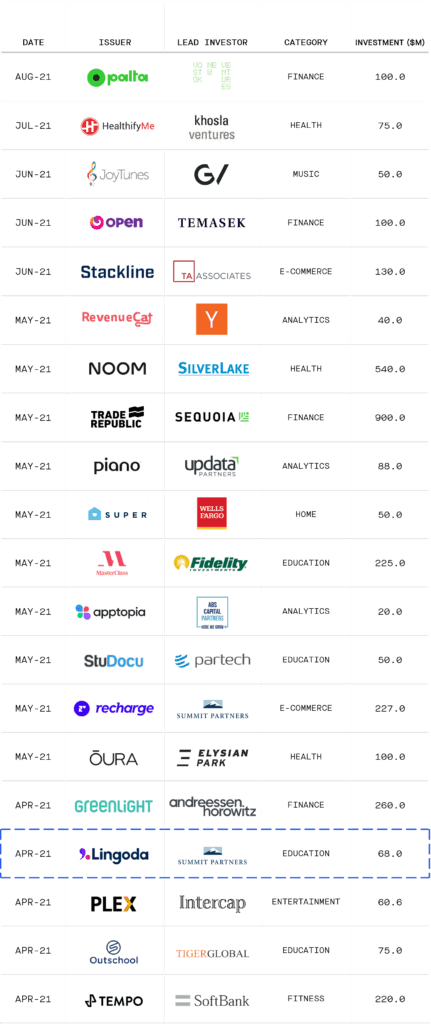

Private

financing surging

Sources: Capital IQ and Pitchbook as of 21 July 2021

GP Bullhound

key CSS insights

key CSS insights

Truth

about LTV

Debunking the issues of customer

lifetime value

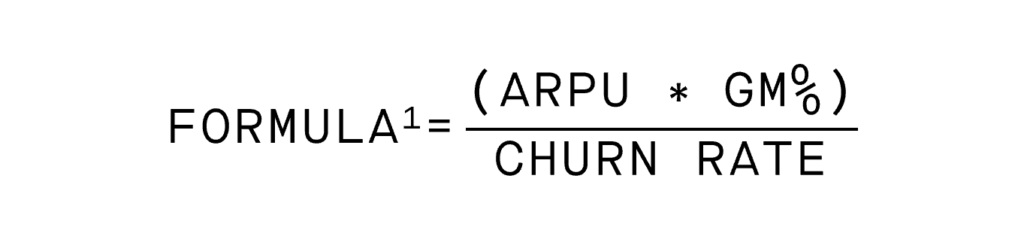

The LTV formula has several issues that

need to be understood:

- The formula assumes that all users eventually churn at an even percentage each year or average

- It does not take into consideration factors such as upsells and re-subscriptions

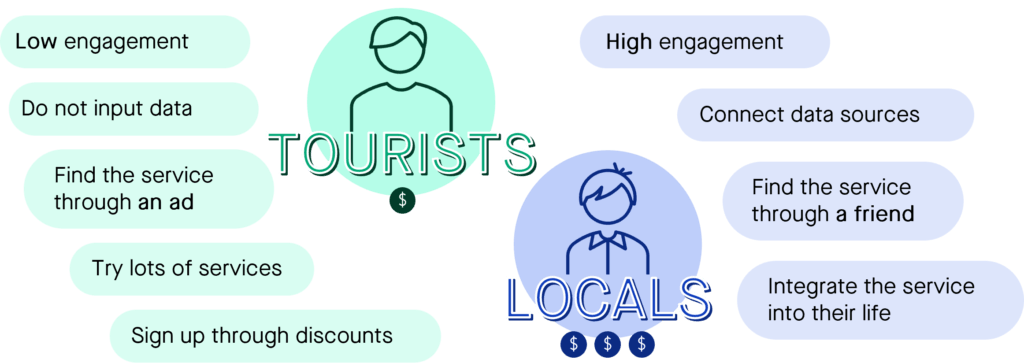

LTV does not account for fundamentally different user profiles – discounts the ‘locals’ that stay for LIFE and over-emphasises the high ‘tourists’ churn

To estimate LTV in

early-stage companies:

Find the locals

Find the locals

- LTV engagement – comments, photos, shares, posting activity, connecting data sources, and logins

- Track auto-subscribe from Apple/Google

- Web-users versus app only

- Tools to measure engagement – e.g. RevenueCat, AppsFlyer, and Recurly

Measurement solutions

Note: ARPU = average revenue per user; GM = gross margin

- Divide users into ‘locals’ vs ‘tourists’ cohorts by looking at engagement metrics

- Estimate the value of ‘lifetime users’ in the local cohort and then calculate each cohorts’ LTV

- Focus on the acquisition of ‘locals’ and optimise marketing not for just sign-ups and return on advertising spend (ROAS), but for long-term usage

- Discuss your average LTV, as it's important for your customer acquisition cost (CAC) payback, but ensure you highlight the potential of your ‘locals’

Definition of LTV

(Lifetime value)

(Lifetime value)

LTV captures a user’s gross profit that

is ‘scheduled’ to be

delivered to the company over the lifetime of the user

LTV issues

The

new era of customer acquisition is organic

- Organic customer acquisition strategies are critical for CSS companies

- Generating a sustainable, low customer acquisition cost (CAC) delivery model is crucial to ensuring a sustainable, profitable subscription business

- Successful, new-age CSS enterprises leverage low-cost or free channels to find and attract customers

- Each CSS business must choose a strategy to find new customers and integrate that into its services as a feature or integral part of the offering

- The customer acquisition method is then organic or less invasive to the consumer, resulting in higher conversion and retention

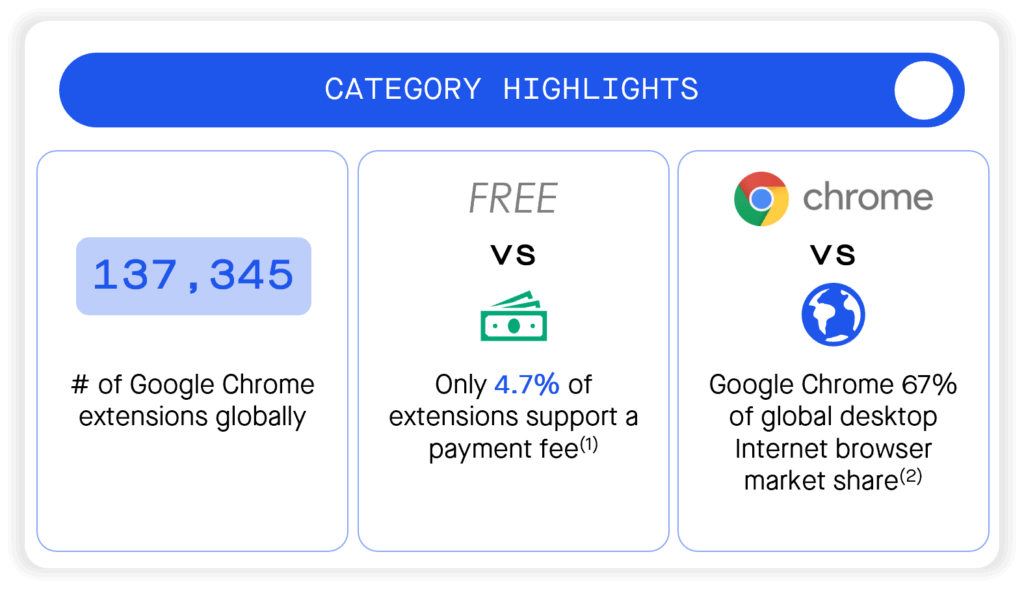

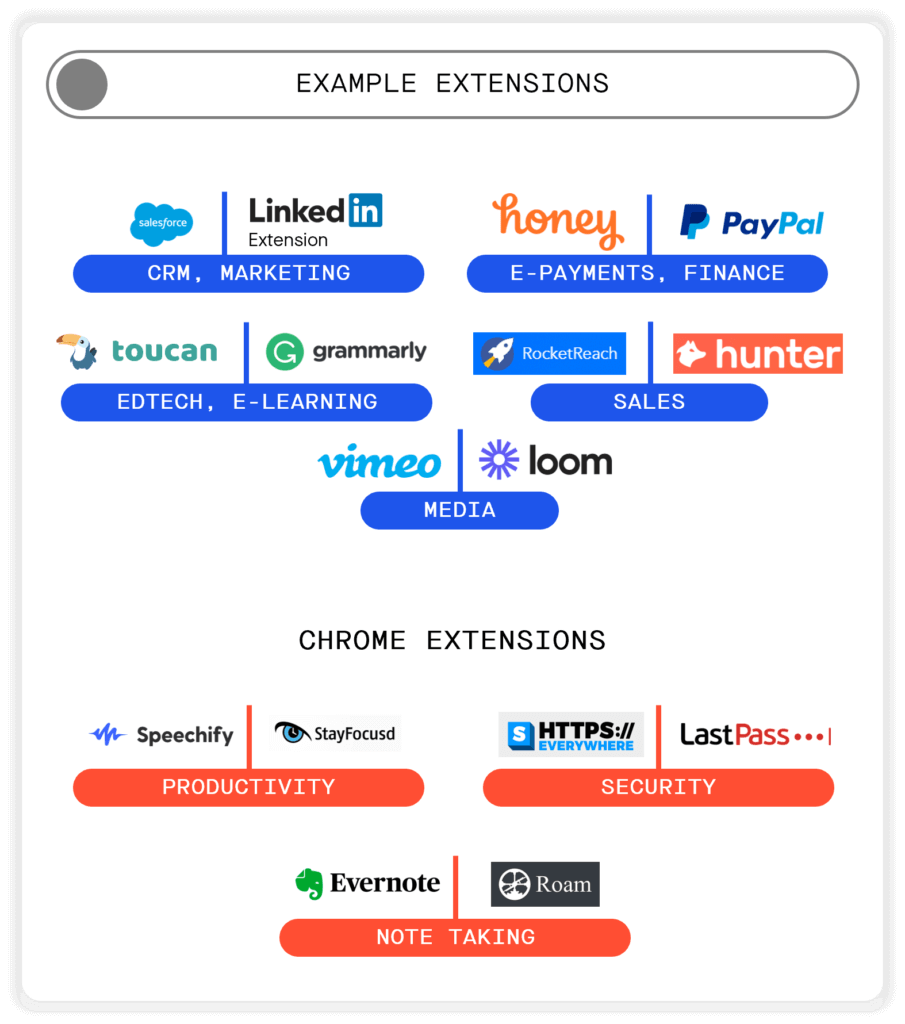

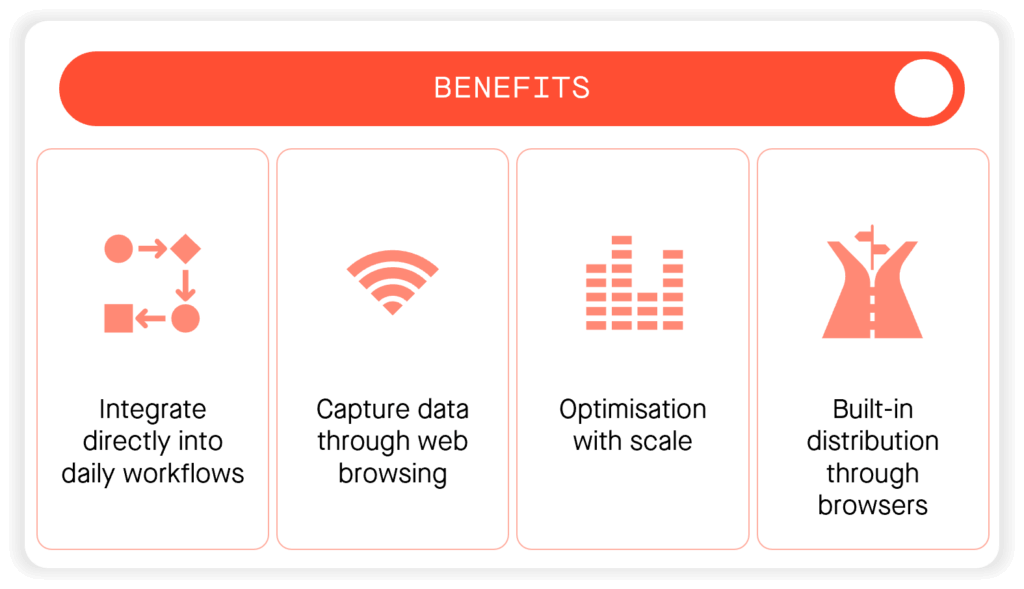

Internet

browser extensions can be big businesses

A browser extension is a small software

module for customising a

web browser

Browsers typically allow a variety of

extensions, including user interface modifications, ad-blocking, and cookie

management

Note: 1) Debugbear; and 2) Statista – Global desktop Internet browsers

market share 2015-2021

Hardware

unlocks the modern-day subscription

Connected hardware has become a trojan

horse for a recurring software subscription but consumers are smart – the

software must enable a better service and constantly keep the experience

refreshed – a true symbiotic relationship

Once users commit to the hardware

purchase, the expected retention rate for the subscription is high

This trend began with connected

fitness, but hardware-enabled software has expanded into many new verticals

Western

CSS versus Eastern micropayments

- Western users focus on discrete, specialised apps that address specific use cases

- While Western users are often willing to subscribe to different apps, too many can add up, be hard to keep track of, and lead to fatigue

- As a result, developers are opting for options that allow them to capture ad revenue from free users who choose to build their own stacks

- Micropayments through tipping, donations and pay per episode has become widespread

- Users prefer comprehensive ‘super apps’ for all their app-based needs, including messaging, personal finance, and entertainment

- Users can quickly connect their profiles to a variety of services using existing Alipay or WeChat payment platforms

‘Pay per engagement’ platforms are

rapidly expanding in the West, led by Patreon,

Cameo, and OnlyFans

Use cases where users only want limited

engagement can still be monetised to

encourage them to subscribe

Customised and

exclusive offerings involving customised

messages, photos and limited merchandise are attracting more users to digital

experiences

Rapid expansion of subscriptions given

the benefits for both the user and businesses

Note: 1) Tencent 20-F, 2021

Chinese media giant Tencent reported that nearly 3x more revenue came from CSS than online advertising in 20201

Expert views from venture builders

WHY

MONITISE TO PARENTS IN A CSS MODEL VERSUS SCHOOLS IN A LICENSING MODEL?

In its early days, PlayOn! Sports explored both models – selling to schools and selling to fans. Ultimately, we chose the subscription model for fans as selling to schools is extremely challenging; schools have limited budgets for discretionary expenses and those budgets are tied to tax revenues and overall economic health. Budgets can be very cyclical and lead to substantial churn among schools. Ultimately, the model we chose was to invest up-front and install automated production cameras at schools for free. This upfront investment won over the schools and significantly reduced sales friction. We also found that parents love the convenience and easy-to-manage subscription offerings to watch their kids play sports. This has resulted in attractive unit economics for PlayOn! Sports leveraging a CSS model.

WHY DID YOU FOCUS ON STREAMING VS. BROADCAST TV FOR LOCAL SPORTS?

High school sports occur in every city in the United States, with over 3 million events a year. Each event has a limited, albeit passionate audience, that makes it difficult to justify an expensive TV production. There are some marquee high school events, like football and basketball games, that are carried on local TV channels, but the rest of the high school sports ecosystem doesn’t have the audience base to justify television production and distribution. Instead, PlayOn! Sports has leveraged technology advances, such as automated production camera technology and Internet streaming to be able to produce ANY AND EVERY high school event for an extremely low marginal cost. By standardising our model, we have a national distribution footprint consisting of local coverage. Each event drives incremental subscriber acquisition and significant retention as high school sports is worshipped in most US states. With our increased scale, we covered over 300, 000 events this school year and expect to cover over 1 million in 2021/22 school year.

WHAT IS PLAYON! SPORTS’S USER-ACQUISITION STRATEGY AND WHY HAS IT BEEN SUCCESSFUL?

PlayOn! Sports works with the state athletic associations and the individual high schools as partners, where we all provide services to the other. PlayOn! installs automated production cameras, which allows the schools to promote their athletic events and enables high school fans to watch their teams – regardless of where they live. In exchange, PlayOn! Sports benefits from proprietary local content that has a passionate and sticky audience base. PlayOn! sells consumer subscriptions, and the schools and associations benefit through a revenue share. Our partners utilise their marketing channels to generate organic referrals, which dramatically lowers our CAC. As we enter new markets or launch a new school, we utilise paid marketing through the traditional digital marketing channels to let parents know of PlayOn! Sports’s service and to build a base level of users. We keep our CAC low by marketing individual events to a very targeted audience, but we do this at massive scale.

ARE YOU CONCERNED ABOUT THE CHURN OF CUSTOMERS LEAVING THE SERVICE?

At PlayOn! Sports, we have two groups of customers – 'content partners', the schools and athletic associations and the 'end viewers' – fans/parents/students/alumni. We are extremely focused on ensuring that the schools and athletic associations feel valued and have a great experience with the partnership. So far this has been very successful as we have had non-existent churn in schools over the last 4-5 years. On the customer front, we built our model to include churn as sports seasons end, students graduate, etc. However, our model features a low cost-of-content and our CAC remains affordable and predictable given the organic nature of our customer acquisition strategy. This enables us to operate with profitable LTVs and unit-economics even with predictable end-viewer churn.

In its early days, PlayOn! Sports explored both models – selling to schools and selling to fans. Ultimately, we chose the subscription model for fans as selling to schools is extremely challenging; schools have limited budgets for discretionary expenses and those budgets are tied to tax revenues and overall economic health. Budgets can be very cyclical and lead to substantial churn among schools. Ultimately, the model we chose was to invest up-front and install automated production cameras at schools for free. This upfront investment won over the schools and significantly reduced sales friction. We also found that parents love the convenience and easy-to-manage subscription offerings to watch their kids play sports. This has resulted in attractive unit economics for PlayOn! Sports leveraging a CSS model.

WHY DID YOU FOCUS ON STREAMING VS. BROADCAST TV FOR LOCAL SPORTS?

High school sports occur in every city in the United States, with over 3 million events a year. Each event has a limited, albeit passionate audience, that makes it difficult to justify an expensive TV production. There are some marquee high school events, like football and basketball games, that are carried on local TV channels, but the rest of the high school sports ecosystem doesn’t have the audience base to justify television production and distribution. Instead, PlayOn! Sports has leveraged technology advances, such as automated production camera technology and Internet streaming to be able to produce ANY AND EVERY high school event for an extremely low marginal cost. By standardising our model, we have a national distribution footprint consisting of local coverage. Each event drives incremental subscriber acquisition and significant retention as high school sports is worshipped in most US states. With our increased scale, we covered over 300, 000 events this school year and expect to cover over 1 million in 2021/22 school year.

WHAT IS PLAYON! SPORTS’S USER-ACQUISITION STRATEGY AND WHY HAS IT BEEN SUCCESSFUL?

PlayOn! Sports works with the state athletic associations and the individual high schools as partners, where we all provide services to the other. PlayOn! installs automated production cameras, which allows the schools to promote their athletic events and enables high school fans to watch their teams – regardless of where they live. In exchange, PlayOn! Sports benefits from proprietary local content that has a passionate and sticky audience base. PlayOn! sells consumer subscriptions, and the schools and associations benefit through a revenue share. Our partners utilise their marketing channels to generate organic referrals, which dramatically lowers our CAC. As we enter new markets or launch a new school, we utilise paid marketing through the traditional digital marketing channels to let parents know of PlayOn! Sports’s service and to build a base level of users. We keep our CAC low by marketing individual events to a very targeted audience, but we do this at massive scale.

ARE YOU CONCERNED ABOUT THE CHURN OF CUSTOMERS LEAVING THE SERVICE?

At PlayOn! Sports, we have two groups of customers – 'content partners', the schools and athletic associations and the 'end viewers' – fans/parents/students/alumni. We are extremely focused on ensuring that the schools and athletic associations feel valued and have a great experience with the partnership. So far this has been very successful as we have had non-existent churn in schools over the last 4-5 years. On the customer front, we built our model to include churn as sports seasons end, students graduate, etc. However, our model features a low cost-of-content and our CAC remains affordable and predictable given the organic nature of our customer acquisition strategy. This enables us to operate with profitable LTVs and unit-economics even with predictable end-viewer churn.

Land

and expand with hardware

CEO

David rudolph

long-term

vision

scale

We deliver live US high-school sports events to fans whenever and

wherever they want it

Cover every US high school game across every sport and then apply our model to other niche sports or underserved content verticals

300,000 games streamed in 2020/21 and more than 1 million in 2021/22

More than 700,000 active subscribers

More than 700,000 active subscribers

mission

WHAT

DOES TOUCAN DO AND WHY DID YOU CHOOSE A CSS MODEL VS. ADVERTISING?

Toucan is a web browser extension that helps people learn a new language while going about their day. Each time you visit a website, Toucan picks certain words to translate into your new language so you can learn them within the context of a language you’re already comfortable with. We chose a CSS model so we could offer a compelling free product while creating a compounding and predictable business model that grows and sustains the company. With a premium subscription tier, we can offer high quality features that our customers expect and demand and still provide a high-quality free experience for anyone interested in learning a new language.

WHY DID YOU AND YOUR TEAM DECIDE TO BUILD TOUCAN AS A BROWSER-BASED BUSINESS VS. A MOBILE APP BUSINESS?

The short answer is that we wanted to meet people where they were… The three co-founders of Toucan have worked at some of the best consumer tech and mobile app companies in the world, including Headspace. And a huge, consistent problem with consumer educational products is that it’s hard to get people to take time out of their busy day, even for just a few minutes. Plus, competition for time on people’s phones is only going to get more intense. So, rather than be one more thing on someone’s to-do list, we decided to build Toucan on top of people’s existing Internet browsing behaviour so they could learn while they went through their normal day. Not to mention, there are approximately 200,000 Google extension offerings vs. millions of apps, so the competition is substantially lower.

DO YOU HAVE ANY CONCERNS THAT THE MAJOR BROWSERS MAY SUDDENLY BLOCK TOUCAN?

Nope, not at all. Most browsers are looking for ways to differentiate themselves and become more valuable, useful tools for consumers. Toucan makes people’s time on these browsers even more valuable, while also respecting their privacy. In fact, we have such confidence in the browser extension ecosystem that we’ve recently launched on Safari, Firefox, Brave, and Edge.

WHAT’S NEXT FOR TOUCAN?

We’re focused on making Toucan better and reaching even more people with it. That means launching on more browsers, adding new languages to learn, and polishing the core experience so that we can teach better and more effectively. We’re already rapidly winning over consumers and converting them to our paid product.

Toucan is a web browser extension that helps people learn a new language while going about their day. Each time you visit a website, Toucan picks certain words to translate into your new language so you can learn them within the context of a language you’re already comfortable with. We chose a CSS model so we could offer a compelling free product while creating a compounding and predictable business model that grows and sustains the company. With a premium subscription tier, we can offer high quality features that our customers expect and demand and still provide a high-quality free experience for anyone interested in learning a new language.

WHY DID YOU AND YOUR TEAM DECIDE TO BUILD TOUCAN AS A BROWSER-BASED BUSINESS VS. A MOBILE APP BUSINESS?

The short answer is that we wanted to meet people where they were… The three co-founders of Toucan have worked at some of the best consumer tech and mobile app companies in the world, including Headspace. And a huge, consistent problem with consumer educational products is that it’s hard to get people to take time out of their busy day, even for just a few minutes. Plus, competition for time on people’s phones is only going to get more intense. So, rather than be one more thing on someone’s to-do list, we decided to build Toucan on top of people’s existing Internet browsing behaviour so they could learn while they went through their normal day. Not to mention, there are approximately 200,000 Google extension offerings vs. millions of apps, so the competition is substantially lower.

DO YOU HAVE ANY CONCERNS THAT THE MAJOR BROWSERS MAY SUDDENLY BLOCK TOUCAN?

Nope, not at all. Most browsers are looking for ways to differentiate themselves and become more valuable, useful tools for consumers. Toucan makes people’s time on these browsers even more valuable, while also respecting their privacy. In fact, we have such confidence in the browser extension ecosystem that we’ve recently launched on Safari, Firefox, Brave, and Edge.

WHAT’S NEXT FOR TOUCAN?

We’re focused on making Toucan better and reaching even more people with it. That means launching on more browsers, adding new languages to learn, and polishing the core experience so that we can teach better and more effectively. We’re already rapidly winning over consumers and converting them to our paid product.

Delivering

perpetual learning through software

taylor nieman

ceo

long-term

vision

scale

To make the world bilingual

To create a healthy, empowering community that breaks down cultural barriers

150,000+ monthly active users (MAU)

mission

SEXY

AUDIO STORIES THAT SPARK YOUR IMAGINATION AND MOOD

WHY

BUILD DIPSEA AND WHO IS YOUR TARGET CUSTOMER?

We are helping women tap into their sexuality on their own terms. Lots of the female-focused solutions on the market today are clinical in nature. Most erotic entertainment is made by and for men, but women have the same demand for content. We saw a big gap in female-focused content. Our core demographic is women aged 18 to 34. Dipsea solves that big gap in content by providing our users grounded in aspirational reality and designed to inspire through imagination and fantasy.

WHY CHOOSE CSS VERSUS OTHER REVENUE STREAMS?

A CSS business model is great for Dipsea for a few reasons. Our users have a regular demand for our content – we are closer to Netflix versus a dating app. We consistently refresh our content so that our users find something new every week – resulting in continuous entertainment deserving of a subscription. Finally – our users crave a premium experience and have become comfortable with a subscription offering.

DO YOU WORRY ABOUT PEOPLE BECOMING SUBSCRIPTION FATIGUED?

Not really. As long as the subscription is providing value and people are using the app consistently and it's making their life better, they won’t cancel.

WHAT IS YOUR USER ACQUISITION STRATEGY?

Currently, a large part of our growth is organic. Investors weren’t sure if people would want to talk about erotic content when we started pitching Dipsea. There has been a big cultural shift in willingness to talk about personal issues and interests more. Younger people are just more comfortable sharing in this category. In addition, Dipsea by its nature is a press-worthy topic so we get solid engagement there. We are also leveraging paid channels and have had a lot of success with podcast advertising. Given the similar audio experience, we have found a lot of users through dating and female-focused podcasts.

HOW HAS YOUR VISION FOR THE COMPANY EVOLVED?

Our Core mission is still the same – serving women in this space still has so much room to grow. While our core demographic is 24-35, our fastest-growing category is 18-24. But we will continue supporting women throughout major points in their lives.

We are helping women tap into their sexuality on their own terms. Lots of the female-focused solutions on the market today are clinical in nature. Most erotic entertainment is made by and for men, but women have the same demand for content. We saw a big gap in female-focused content. Our core demographic is women aged 18 to 34. Dipsea solves that big gap in content by providing our users grounded in aspirational reality and designed to inspire through imagination and fantasy.

WHY CHOOSE CSS VERSUS OTHER REVENUE STREAMS?

A CSS business model is great for Dipsea for a few reasons. Our users have a regular demand for our content – we are closer to Netflix versus a dating app. We consistently refresh our content so that our users find something new every week – resulting in continuous entertainment deserving of a subscription. Finally – our users crave a premium experience and have become comfortable with a subscription offering.

DO YOU WORRY ABOUT PEOPLE BECOMING SUBSCRIPTION FATIGUED?

Not really. As long as the subscription is providing value and people are using the app consistently and it's making their life better, they won’t cancel.

WHAT IS YOUR USER ACQUISITION STRATEGY?

Currently, a large part of our growth is organic. Investors weren’t sure if people would want to talk about erotic content when we started pitching Dipsea. There has been a big cultural shift in willingness to talk about personal issues and interests more. Younger people are just more comfortable sharing in this category. In addition, Dipsea by its nature is a press-worthy topic so we get solid engagement there. We are also leveraging paid channels and have had a lot of success with podcast advertising. Given the similar audio experience, we have found a lot of users through dating and female-focused podcasts.

HOW HAS YOUR VISION FOR THE COMPANY EVOLVED?

Our Core mission is still the same – serving women in this space still has so much room to grow. While our core demographic is 24-35, our fastest-growing category is 18-24. But we will continue supporting women throughout major points in their lives.

faye keegan

CTO/CO-FOUNDER

long-term

vision

scale

Empower women to tap into their sexuality on their

own terms

Become a trusted partner for women as they move through their

lives

The idea that what we make is niche

is wildly incorrect

mission

Venture

capital mandates for css

businesses

HOW

DO YOU THINK ABOUT THE EVOLUTION OF THE CSS INVESTMENT ECOSYSTEM?

DCM believes that we are in the middle of a big shift in the consumer Internet. Historically, the primary method has been monetisation through ads or the sale of data and now we believe subscriptions will come to be very important. We see three characteristics where CSS businesses have the potential to be category winners – High gross margins, Recurring revenue, Potential for exponential growth with organic customer acquisition.

HOW ARE YOU PICKING WINNERS IN THE CONSUMER TECH SPACE?

The first thing we do in any CSS investment is ask ourselves how these businesses are growing. Are they acquiring customers efficiently with primary organic customer acquisition methods? Do they have a unique organic strategy of finding consumers or generating word-of-mouth growth? Second, we focus on subscription retention, which is key for DCM. At the earliest stages, retention calculations are more guess work vs. a pure science. To arrive at a proxy, we look at what we believe are the early symbols of high retention businesses – WAU/MAU levels. One thing that is always hard is TAM or Market size. VCs are bad here, so we think about it last.

Examples of 'investmnet no' for DCM include:

WHAT IS ONE THING FOUNDERS CAN FOCUS ON IMPROVING AT THE EARLY STAGES OF THEIR BUSINESS?

Poor pricing strategy is a big area for improvement. A lot of CSS businesses underprice the value they bring to consumers. Founders need to ask – what am I replacing or improving in someone’s life? For example, Breathwork is a mindful breathing business that we are a fan of. How do you create a price for breathing – which someone can do for free now?

DCM INVESTS IN CHINA AND THE US – HOW DO YOU THINK ABOUT CONSUMER BUSINESSES IN EACH COUNTRY?

The prevailing wisdom is that Asia is leading with its superapps like WeChat and Alibaba, but users in China are not used to paying for apps in the consumer subscription model. They are instead interacting in a more transactional model by either tipping influencers or buying individual content. I think that is why you have seen some of the Western apps become so powerful globally as they can leverage their subscription revenue to grow faster and add more services.

DCM believes that we are in the middle of a big shift in the consumer Internet. Historically, the primary method has been monetisation through ads or the sale of data and now we believe subscriptions will come to be very important. We see three characteristics where CSS businesses have the potential to be category winners – High gross margins, Recurring revenue, Potential for exponential growth with organic customer acquisition.

HOW ARE YOU PICKING WINNERS IN THE CONSUMER TECH SPACE?

The first thing we do in any CSS investment is ask ourselves how these businesses are growing. Are they acquiring customers efficiently with primary organic customer acquisition methods? Do they have a unique organic strategy of finding consumers or generating word-of-mouth growth? Second, we focus on subscription retention, which is key for DCM. At the earliest stages, retention calculations are more guess work vs. a pure science. To arrive at a proxy, we look at what we believe are the early symbols of high retention businesses – WAU/MAU levels. One thing that is always hard is TAM or Market size. VCs are bad here, so we think about it last.

Examples of 'investmnet no' for DCM include:

- Payback on CAC > 12 months and no sure way to get payback timelines to trend down

- Limited organic need for product

- The core audience is hard to find

- Lots of competition already

WHAT IS ONE THING FOUNDERS CAN FOCUS ON IMPROVING AT THE EARLY STAGES OF THEIR BUSINESS?

Poor pricing strategy is a big area for improvement. A lot of CSS businesses underprice the value they bring to consumers. Founders need to ask – what am I replacing or improving in someone’s life? For example, Breathwork is a mindful breathing business that we are a fan of. How do you create a price for breathing – which someone can do for free now?

DCM INVESTS IN CHINA AND THE US – HOW DO YOU THINK ABOUT CONSUMER BUSINESSES IN EACH COUNTRY?

The prevailing wisdom is that Asia is leading with its superapps like WeChat and Alibaba, but users in China are not used to paying for apps in the consumer subscription model. They are instead interacting in a more transactional model by either tipping influencers or buying individual content. I think that is why you have seen some of the Western apps become so powerful globally as they can leverage their subscription revenue to grow faster and add more services.

Mission

DCM partners with inspired entrepreneurs to build high-impact,

global technology companies

Its global DNA and extensive industry expertise

are foundational to maximising the success of the entrepreneurs

investments

david cheng

principal

Venture

capital mandates for css

businesses

HOW

DO YOU THINK ABOUT THE EVOLUTION OF THE CSS INVESTMENT ECOSYSTEM?

TCG is staying very active in our core consumer verticals which includes CSS as well as ad driven and ecommerce business models. One thing we have noticed is that a lot of businesses that don’t have a natural need or fit for a subscription product are trying to shoehorn in a subscription model. For example, a great business that gets a lot of website traffic and engagement tries to integrate a subscription offering. That may ultimately be less successful vs. keeping the top of the funnel wide open and integrating ads or ecommerce options. Consequently, we are seeing the blurring of the edge of traditional CSS businesses. Another trend we have been seeing is that traditional enterprise SaaS terms have become very ubiquitous. Consequently, some of these terms have been adopted by consumer businesses where they don’t accurately capture the true business KPIs. In a lot of cases these consumer businesses are trying to use the same 'SaaS Lingua Franca' to speak to investors and it can cause confusion – i.e. – what does CSS ARR truly mean?

HOW ARE YOU PICKING WINNERS IN THE CONSUMER TECH SPACE?

TCG has deep consumer DNA from our founding days. We look for businesses that were created out of authentic passion. Businesses where the founders built something that they and their friends wanted to have and felt the market need. We stay away from 'born in a boardroom business'. For example, within our portfolio, some of the best consumer tech businesses are accidental companies built out of pure passion. We invested in Surfline, which has been around for years. The founder built the business up over time with one north star – real surfers need to know the conditions of the waves. They started monetising with ads and gradually graduated to consumer subscription offerings.

HOW DO YOU THINK ABOUT VALUATION FOR CSS BUSINESSES AS AN INVESTOR?

Valuation is just one aspect of our evaluation process. We love durable and passionate businesses that have the opportunity for blended business models – commerce/content/ads/subscription/data access. Ideal investments for us have more than one revenue stream or the potential to add more ways to provide value to their customers. Our primary focus is more on the brand and consumer engagement and then we get to valuation.

TCG is staying very active in our core consumer verticals which includes CSS as well as ad driven and ecommerce business models. One thing we have noticed is that a lot of businesses that don’t have a natural need or fit for a subscription product are trying to shoehorn in a subscription model. For example, a great business that gets a lot of website traffic and engagement tries to integrate a subscription offering. That may ultimately be less successful vs. keeping the top of the funnel wide open and integrating ads or ecommerce options. Consequently, we are seeing the blurring of the edge of traditional CSS businesses. Another trend we have been seeing is that traditional enterprise SaaS terms have become very ubiquitous. Consequently, some of these terms have been adopted by consumer businesses where they don’t accurately capture the true business KPIs. In a lot of cases these consumer businesses are trying to use the same 'SaaS Lingua Franca' to speak to investors and it can cause confusion – i.e. – what does CSS ARR truly mean?

HOW ARE YOU PICKING WINNERS IN THE CONSUMER TECH SPACE?

TCG has deep consumer DNA from our founding days. We look for businesses that were created out of authentic passion. Businesses where the founders built something that they and their friends wanted to have and felt the market need. We stay away from 'born in a boardroom business'. For example, within our portfolio, some of the best consumer tech businesses are accidental companies built out of pure passion. We invested in Surfline, which has been around for years. The founder built the business up over time with one north star – real surfers need to know the conditions of the waves. They started monetising with ads and gradually graduated to consumer subscription offerings.

HOW DO YOU THINK ABOUT VALUATION FOR CSS BUSINESSES AS AN INVESTOR?

Valuation is just one aspect of our evaluation process. We love durable and passionate businesses that have the opportunity for blended business models – commerce/content/ads/subscription/data access. Ideal investments for us have more than one revenue stream or the potential to add more ways to provide value to their customers. Our primary focus is more on the brand and consumer engagement and then we get to valuation.

mission

investments

TCG invests in companies that define culture and focuses on the

media, entertainment, technology, sports, and consumer and digital media

sectors

Linus walton

vice president

luke beatly

partner

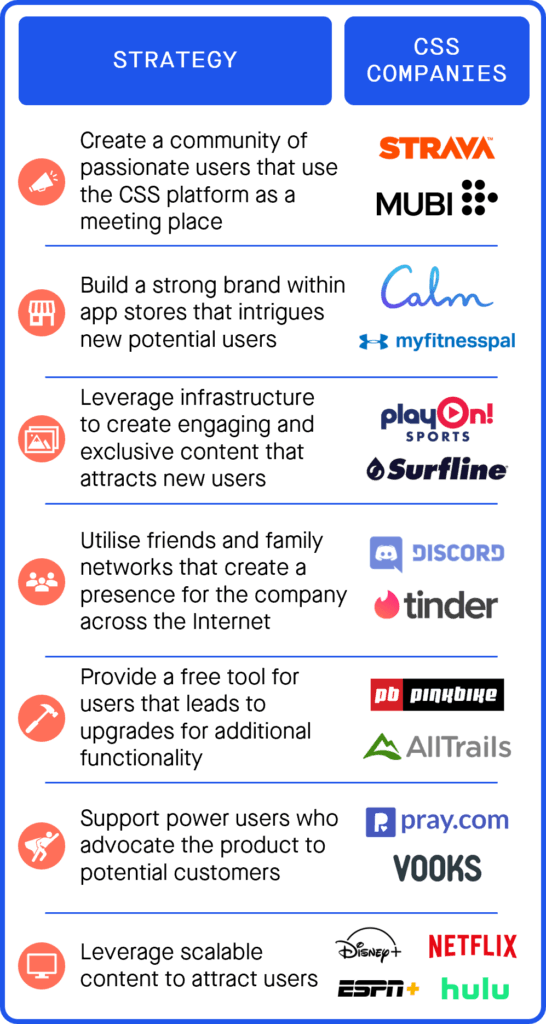

Entertainment was a source of the

explosion of CSS businesses, led by Netflix and Spotify but recently joined by

new entrants such as Mubi and PlayOn! Sports

Entertainment

Fitness, Outdoor, and Lifestyle

The Fitness/Outdoor space has

been the leader in converting freemium users to paid

Many of these companies started offering a free or ad supported tool, but have gradually shifted towards a CSS revenue model for their biggest fans

Many of these companies started offering a free or ad supported tool, but have gradually shifted towards a CSS revenue model for their biggest fans

PROSUMER

Health & Mindfulness

Personal Finance

Prosumer, Health & Mindfulness, and Personal Finance

There has been significant growth

in these categories, with many existing unicorns (Greenlight, Calm, Noom, and Asana) and future unicorns

(Grammarly, Flo, Natural Cycles, and Speechify)

Edtech, Family/Dating, and Other

Edtech and Family/Dating have had an

incredibly challenging yet positive performance through the pandemic as schools

and singles shifted to online ways to engage

Keep a close eye on the Other category as new and exciting CSS businesses are started daily

Keep a close eye on the Other category as new and exciting CSS businesses are started daily

Edtech

family/dating

other

Premier CSS financial

investors

The pool of CSS investors continues to grow

CSS metrics to watch

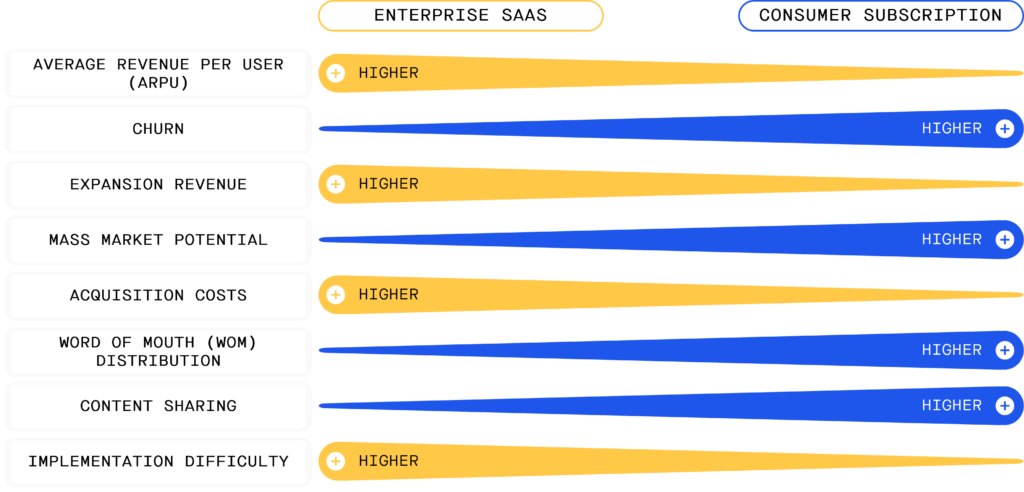

Enterprise

SaaS versus consumer subscription

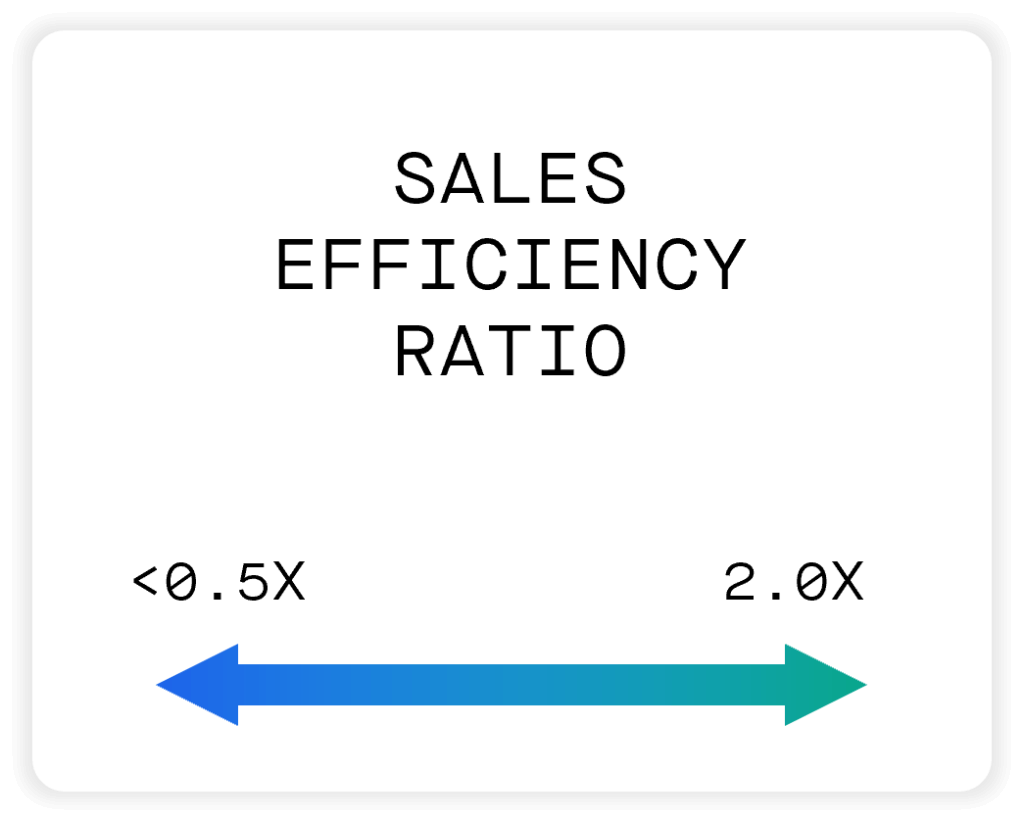

- Investors look at many of the same investment metrics as SaaS companies

- However, key nuances are important to recognise, and CSS businesses will have a different definition of success

- Higher early user churn is typically the biggest hurdle for traditional investors to overcome

- However, entrepreneurs can highlight low customer acquisition cost (CAC) and long-term retention to illustrate the staying potential of their CSS business

Source: Nico Wittenborn at Adjacent (@Adjacent on Twitter)

Investor

benchmarking criteria

CSS investors evaluate each business

based on its own unique attributes as well as sub-industry nuances

There are industry standard metrics that

help investors differentiate good businesses from great businesses

Investor

dive into

key CSS metrics and KPIs

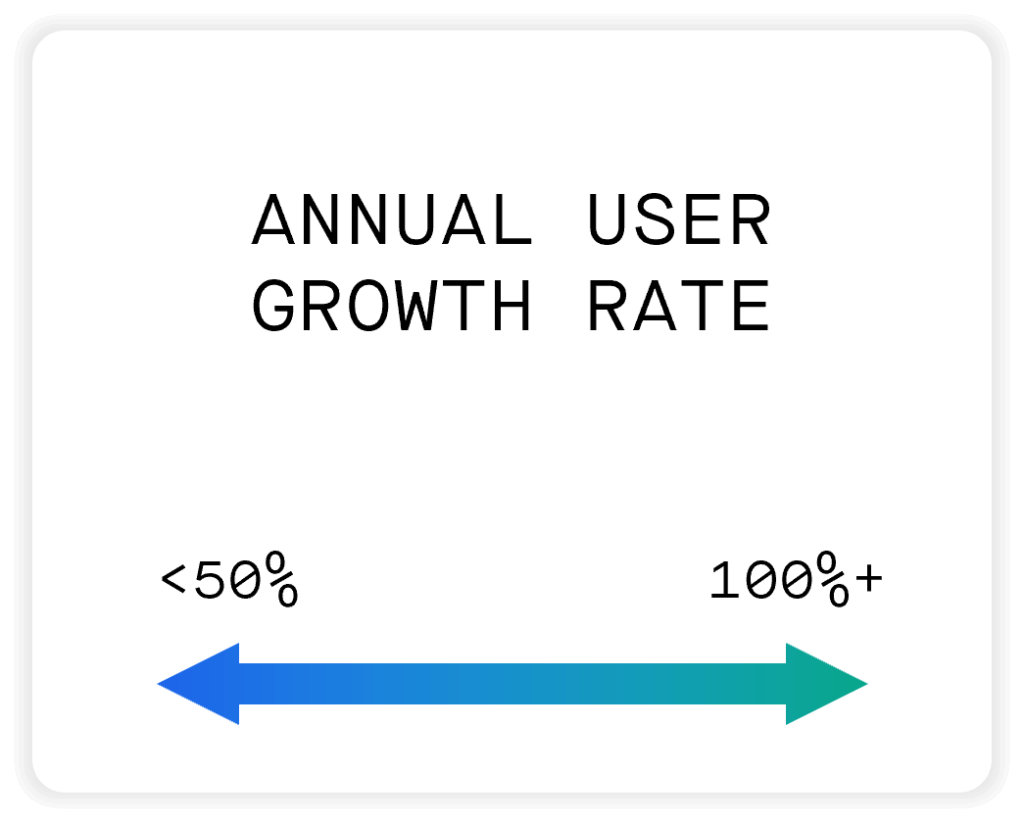

Top-line growth metrics –

user growth & bookings MRR/ARR

user growth & bookings MRR/ARR

- Investors will look closely at users – including the free users, active users (MAU) and most importantly the paid users

- CSS top-line revenue can be measured in several ways:

- Cash bookings: Amounts received each month in upfront subscription payments

- Monthly recurring revenues (MRR), annual recurring revenue (ARR), and GAAP revenue

- Important to show continued efficient growth in top-line metrics

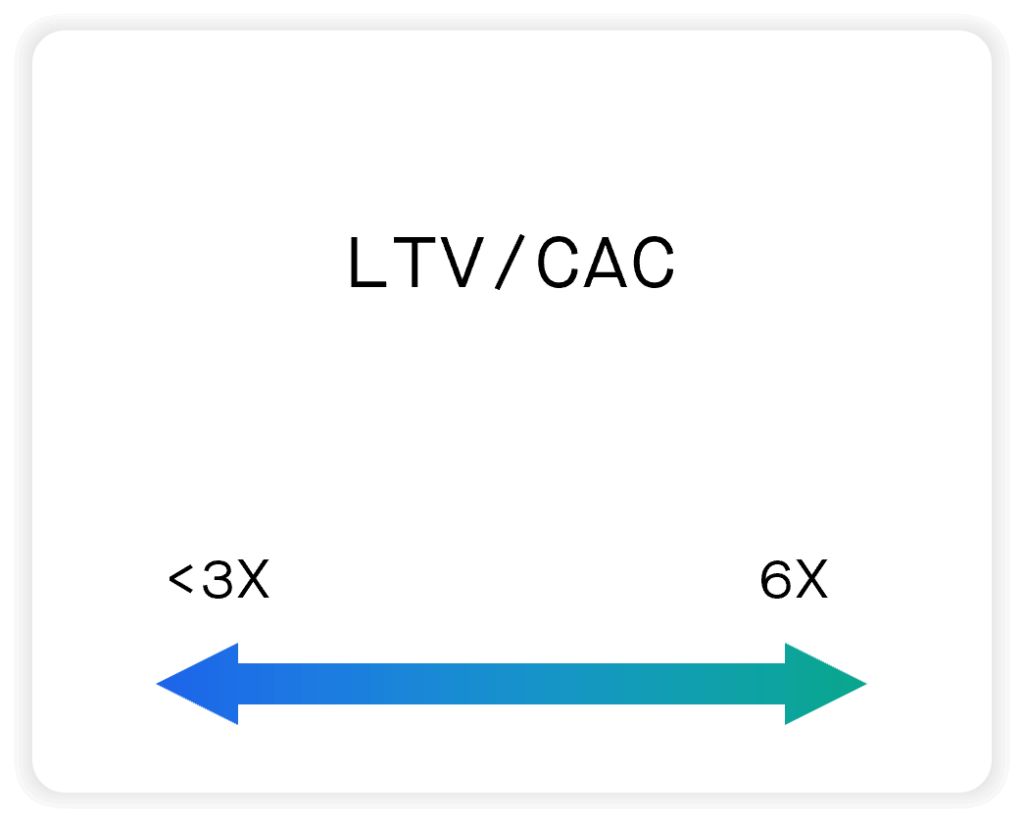

LTV/CAC ratio

- Customer lifetime value = number of months or years the average customer stays with the company multiplied by the ARPU times the gross profit margin (%)

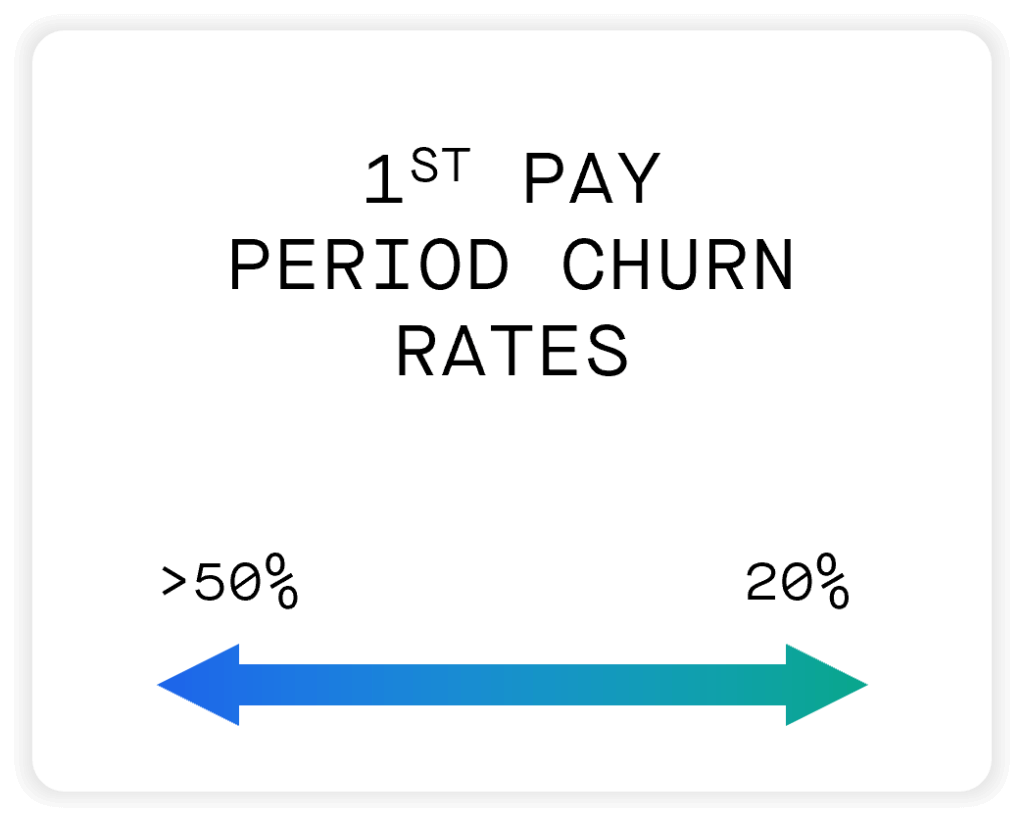

- CSS businesses have the unique attribute in that they typically have high churn after the first pay period or trial period ends Companies typically see churn of first-time users anywhere between 20% and 70% of total sign-ups

- Consequently, investors are looking for retention of users AFTER the first pay period - typically the 3rd, 6th or 12th month. High retention in those periods indicates that users are discovering the value in the service and are likely to be retained long-term, building the ‘CSS cohort layer cake’

- Exceptional CSS businesses renew 50%+ of each annual cohort and 40% of Year 2

- Customer acquisition cost (CAC) payback period is typically stated in months. Represents the time taken to fully pay back sales and marketing investment to acquire a single customer

- CAC payback of <3 month is critical to counter the high churn of initial users

- 50%+ of users coming through organic channels is generally considered great

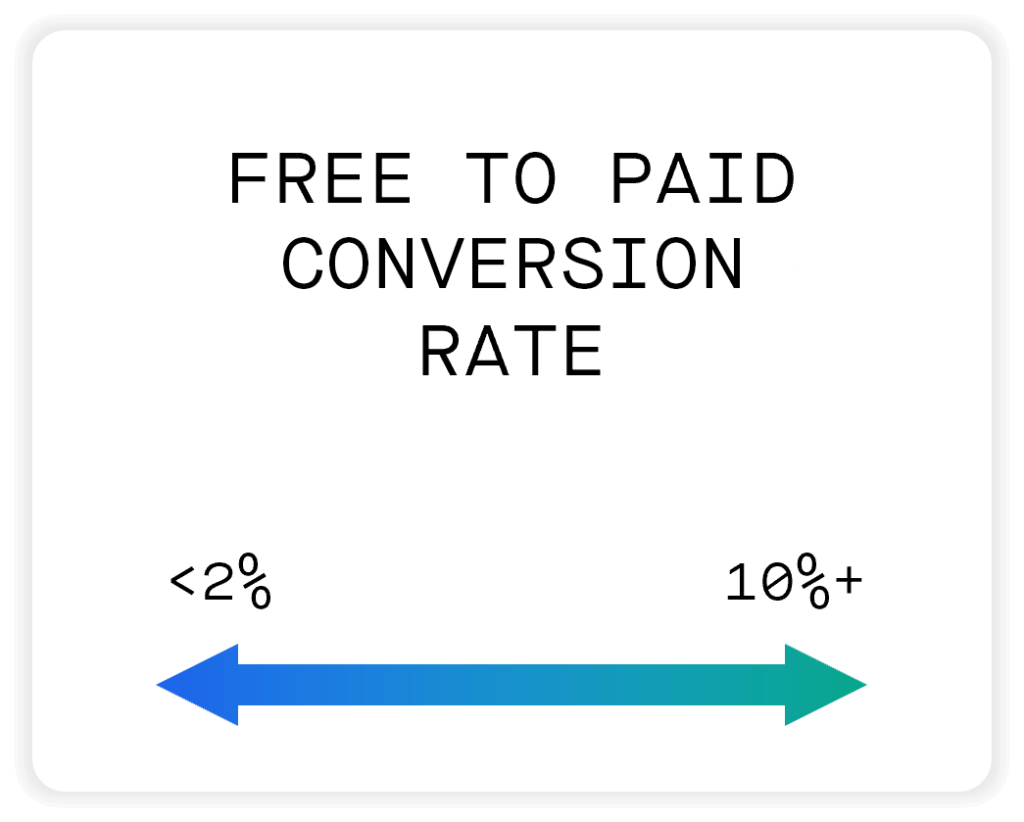

Free to paid conversion rates

- Free users: Number of users using the platform or business. Typically measured monthly or MAU

- Paid users: Number of users paying for a subscription (typically monthly or annually)

- Free to paid conversion rate: The ratio of users who start as free users and convert to paying users. This number varies by industry and type of business as well as how the benefits behind the paywall are structured and accessed

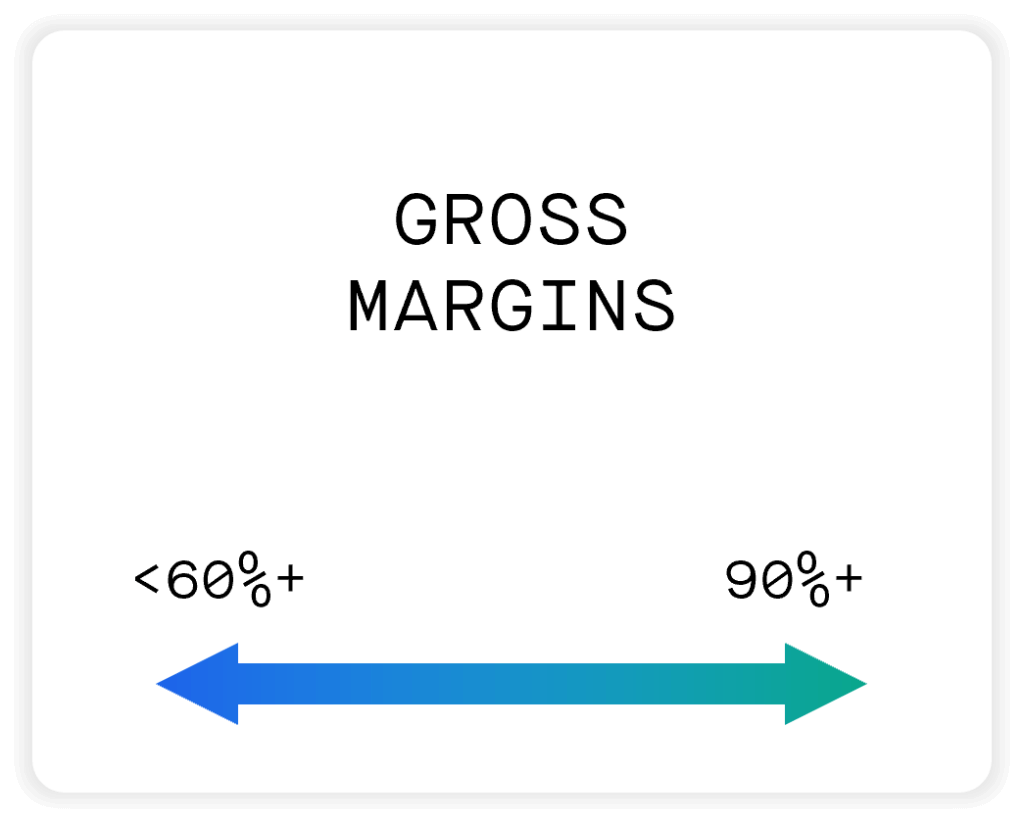

Gross margins

Free cash flow / burn rate

- Growth is of paramount importance, with excess cash being used to fuel growth

- Important, therefore, to understand the cash burn in the business and planning for capital-efficient hyper-growth

- The type of service or content being provided can vary between CSS industries. For example, exercise apps develop fitness classes at a high cost while a hiking app may be leveraging user-generated content (UGC) to enhance its offering

- Typically companies leveraging UGC have higher gross margins and a sustainable competitive advantage as their product and service is influenced and improved by the content and data users are generating

- Investors have been proven willing to pay up for CSS businesses leveraging UGC to provide a unique service

Key

CSS definitions and formulas

Metric

definition & formula

- Normalised measurement of recurring revenue, most frequently measured with a constant value in each month of the subscription period.

Customer acquisition cost (CAC)

- All S&M expenses for new customers. Sometimes excludes personnel management S&M costs.

- Typically measured over a month or quarter.

- Includes users acquired through free and paid channels.

Customer lifetime value (CLV)

- Amount of gross profit a customer is calculated to deliver to the company over the lifetime of the customer.

Payback period

Churn (gross & net)

- The number of months a company requires to pay back its cost of customer acquisition.

- Gross churn is the number of customers lost in a given period or cohort regardless of account expansion or growth.

- Net churn is the number of customers gained or lost in a given period or cohort after taking into consideration new, reactivated, or expanded accounts.

Top-line growth metrics –

user growth & bookings

MRR/ARR

Past CSS insights

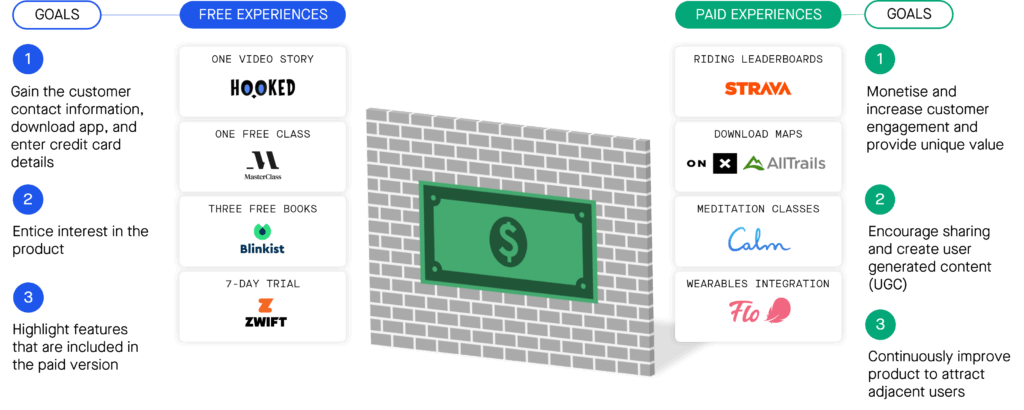

The

importance of the paywall

Success in the CSS space depends on

placement of the paywall within the customer’s experience

Gaining users through a ‘freemium’

offering is critical to encouraging people to try a product. To effectively monetise

them, they need to be converted into paying customers.

That means correctly placing the paywall

at the correct point to provide the maximum value to paying subscribers but

enough functionality to explore the service before paying.

Overcoming

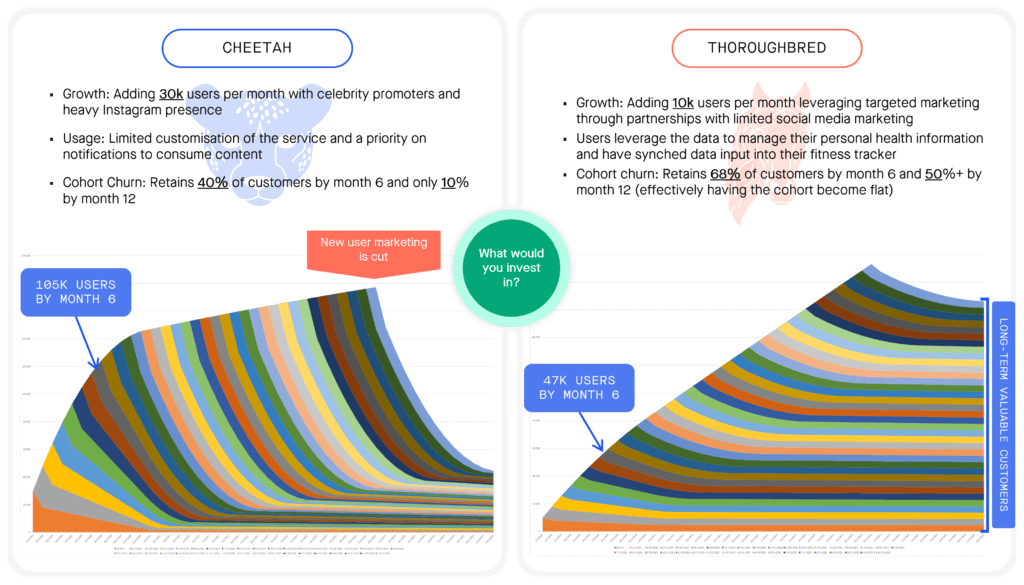

churn to build the ‘cohort revenue layer cake’

As entrepreneurs build their companies,

they can typically invest in growth marketing or product innovation to drive

retention

Focusing on engagement and mitigating

churn will result in a better long-term business than high growth and flashy

advertising

Source: GP Bullhound proprietary analysis

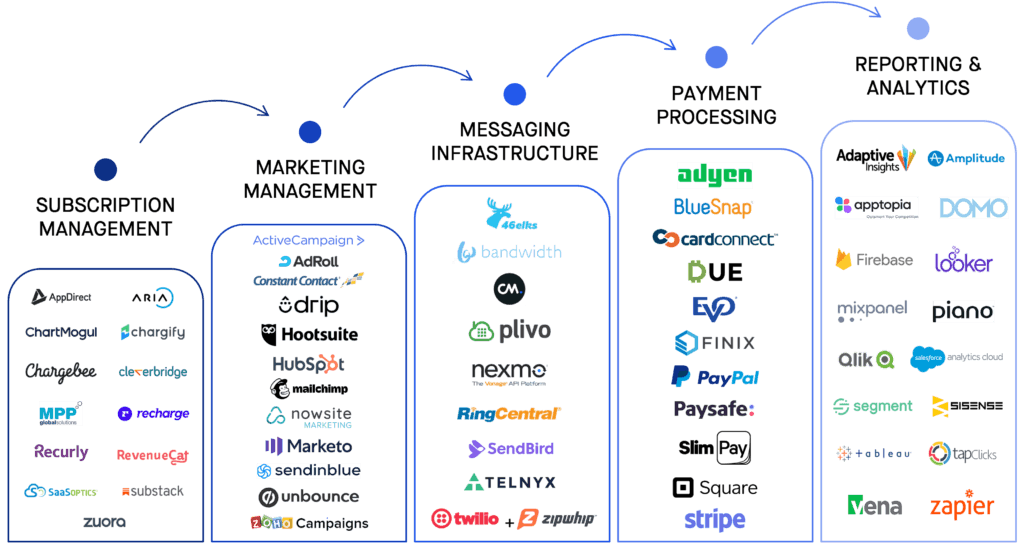

Essential

building blocks of subscription development

Companies are quickly building the

‘pick-axes and blue jeans’ companies of the CSS gold rush

Omnichannel tools are becoming market

ready to allow niche consumer subscription companies to launch quickly

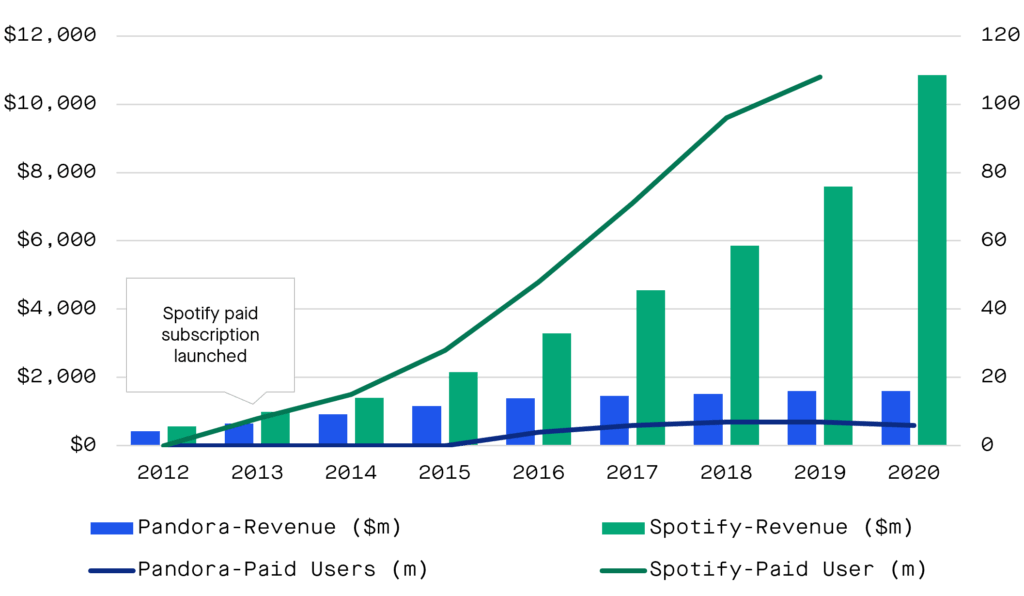

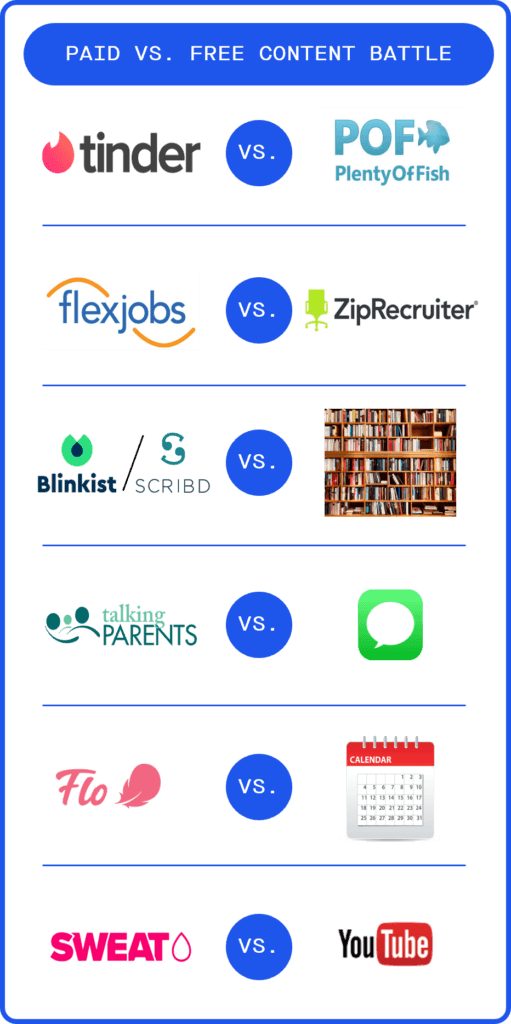

Free

+ advertising versus paid subscription – the ultimate test

That was true in the early ages of the

Internet, but consumers are waking up to the pitfalls of ‘free’, including

intrusive ads, the sale of personal data, and poor product quality

Pandora and Spotify started as free apps,

using ads to generate revenue, and that is where the story diverged

Spotify focused on UX, adding features

like downloading songs and playing music offline behind paywall – paid users quickly accelerated,

revenue surged

Pandora focused only on ads, was late to

the subscription game, and was ultimately sold to Sirius

Sources: Capital IQ and Pitchbook (2020 estimates from

CapIQ)

Historically, investors have been

conditioned to believe that consumers will always prefer a free option

supported by ads versus paying

Pricing

versus utilisation

Our

research has shown that consumers are willing to accept a higher price in

exchange for high usage frequency

Sources: Public data and GP Bullhound research;

8tracks, $30/yr rever, $48/yr

Disclaimer

No information set out or referred

to in this research report shall form the basis of any contract. The issue of

this research report shall not be deemed to be any form of binding offer or

commitment on the part of GP Bullhound LLP. This research report is provided

for use by the intended recipient for information purposes only. It is prepared

on the basis that the recipients are sophisticated investors with a high degree

of financial sophistication and knowledge. This research report and any of its

information is not intended for use by private or retail investors in the UK or

any other jurisdiction.

This research report does not provide personalized advice or recommendations of any kind. You, as the recipient of this research report, acknowledge and agree that no person has nor is held out as having any authority to give any statement, warranty, representation, or undertaking on behalf of GP Bullhound LLP in connection with the contents of this research report. Although the information contained in this research report has been prepared in good faith, no representation or warranty, express or implied, is or will be made and no responsibility or liability is or will be accepted by GP Bullhound LLP. In particular, but without prejudice to the generality of the foregoing, no representation or warranty is given as to the accuracy, completeness or reasonableness of any projections, targets, estimates or forecasts contained in this research report or in such other written or oral information that may be provided by GP Bullhound LLP. The information in this research report may be subject to change at any time without notice.

GP Bullhound LLP is under no obligation to provide you with any such updated information. All liability is expressly excluded to the fullest extent permitted by law. Without prejudice to the generality of the foregoing, no party shall have any claim for innocent or negligent misrepresentation based upon any statement in this research report or any representation made in relation thereto. Liability (if it would otherwise but for this paragraph have arisen) for death or personal injury caused by the negligence (as defined in Section 65 of the Consumer Rights Act 2015) of GP Bullhound LLP, or any of its respective affiliates, agents or employees, is not hereby excluded nor is damage caused by their fraud or fraudulent misrepresentation.

This research report should not be construed in any circumstances as an offer to sell or solicitation of any offer to buy any security or other financial instrument, nor shall they, or the fact of the distribution, form the basis of, or be relied upon in connection with, any contract relating to such action. The information contained in this research report has no regard for the specific investment objectives, financial situation or needs of any specific entity and is not a personal recommendation to anyone. Persons reading this research report should make their own investment decisions based upon their own financial objectives and financial resources and, if in any doubt, should seek advice from an investment advisor.

Past performance of securities is not necessarily a guide to future performance and the value of securities may fall as well as rise. In particular, investments in the technology sector may be subject to frequent fluctuations. The information contained in this research report is based on materials and sources that are believed to be reliable; however, they have not been independently verified and are not guaranteed as being accurate. The information contained in this research report is not intended to be a complete statement or summary of any securities, markets, reports or developments referred to herein.

This research report may contain forward-looking statements, which involve risks and uncertainties. Forward-looking information is provided for illustrative purposes only and is not intended to serve as, and must not be relied upon as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions.

Any and all opinions expressed are current opinions as of the date appearing on the documents included in this research report.

The information contained in this research report should not be relied upon as being an independent or impartial view of the subject matter and for the purposes of the rules and guidance of the Financial Conduct Authority (“the FCA”) this research report is a marketing communication and a financial promotion.

Accordingly, its contents have not been prepared in accordance with legal requirements designed to promote the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

The individuals who prepared the information contained in this research report may be involved in providing other financial services to the company or companies referenced in this research report or to other companies who might be said to be competitors of the company or companies referenced in this research report. As a result, both GP Bullhound LLP and the individual members, directors, officers and/ or employees who prepared the information contained in this research report may have responsibilities that conflict with the interests of the persons who access this research report.

GP Bullhound LLP and/or connected persons may, from time to time, have positions in, make a market in and/ or effect transactions in any investment or related investment mentioned in this research report and may provide financial services to the issuers of such investments. The information contained in this research report or any copy of part thereof should not be accessed by a person in any jurisdictions where its access may be restricted by law and persons into whose possession the information in this research report comes should inform themselves about, and observe, any such restrictions. Access of the information contained in this research report in any such jurisdictions may constitute a violation of UK or US securities law, or the law of any such other jurisdictions. Neither the whole nor any part of the information contained in this research report may be duplicated in any form or by any means. Neither should the information contained in this research report, or any part thereof, be redistributed or disclosed to anyone without the prior consent of GP Bullhound LLP. GP Bullhound LLP and/or its associated undertakings may from time-to-time provide investment advice or other services to, or solicit such business from, any of the companies referred to in the information contained in this research report.

Accordingly, information may be available to GP Bullhound LLP that is not reflected in this material and GP Bullhound LLP may have acted upon or used the information prior to or immediately following its publication. However, no person at GP Bullhound (which includes its members, directors, officers and/or employees), may undertake personal transactions in financial instruments of companies to which this research report relates, without receiving prior clearance from the GP Bullhound Compliance Officer or nominated delegated. In addition, GP Bullhound LLP, the members, directors, officers and/or employees thereof and/or any connected persons may have an interest in the securities, warrants, futures, options, derivatives or other financial instrument of any of the companies referred to in this research report and may from time-to-time add or dispose of such interests. GP Bullhound LLP is a limited liability partnership registered in England and Wales, registered number OC352636, and is authorised and regulated by the Financial Conduct Authority. Any reference to a partner in relation to GP Bullhound LLP is to a member of GP Bullhound LLP or an employee with equivalent standing and qualifications. A list of the members of GP Bullhound LLP is available for inspection at its registered office, 52 Jermyn Street, London SW1Y 6LX.

For US Persons: This research report is distributed to US persons by GP Bullhound Inc. a broker-dealer registered with the SEC and a member of the FINRA. GP Bullhound Inc. is an affiliate of GP Bullhound LLP. All investments bear certain material risks that should be considered in consultation with an investors financial, legal and tax advisors. GP Bullhound Inc. engages in private placement and mergers and acquisitions advisory activities with clients and counterparties in the Technology and CleanTech sectors.

US registered broker-dealer Eric Crowley beneficially owns <1% of the outstanding shares of Speechify, which is a subject company of the present research report.

In addition, the persons involved in the production of this research report certify that the views expressed in this research report accurately reflect their personal views about the subject securities or issuers, and that no part of their compensation was, or will be, directly or indirectly related to the specific views expressed in this report. As such, no person at GP Bullhound (including its members, directors, officers and/or employees) has received, or is authorized to accept, any inducement, whether monetary or in whatsoever form, in counterparty of promise to issue favorable research coverage for the companies to which this research report relates.

In the last twelve months, GP Bullhound LLP or an affiliate is or has been engaged as an advisor to and received compensation from, or has invested in the following companies mentioned in this report: Amazon, Apple, Asana Rebel, CareerFoundry, Cleanshelf, Customer Thermometer, Discord, Facebook, Fishbrain, Flexjobs, Glovo, HackerOne, Klarna, Lingoda, Match Group, Mubi, Oxbotica, Partnerize, PayPal, Pinkbike, Playtomic, RealVNC, Recruitee, Revolut, Salesforce, Signavio, Slack, Spotify, Unity Technologies, Vivino, and Whoop.

This research report does not provide personalized advice or recommendations of any kind. You, as the recipient of this research report, acknowledge and agree that no person has nor is held out as having any authority to give any statement, warranty, representation, or undertaking on behalf of GP Bullhound LLP in connection with the contents of this research report. Although the information contained in this research report has been prepared in good faith, no representation or warranty, express or implied, is or will be made and no responsibility or liability is or will be accepted by GP Bullhound LLP. In particular, but without prejudice to the generality of the foregoing, no representation or warranty is given as to the accuracy, completeness or reasonableness of any projections, targets, estimates or forecasts contained in this research report or in such other written or oral information that may be provided by GP Bullhound LLP. The information in this research report may be subject to change at any time without notice.

GP Bullhound LLP is under no obligation to provide you with any such updated information. All liability is expressly excluded to the fullest extent permitted by law. Without prejudice to the generality of the foregoing, no party shall have any claim for innocent or negligent misrepresentation based upon any statement in this research report or any representation made in relation thereto. Liability (if it would otherwise but for this paragraph have arisen) for death or personal injury caused by the negligence (as defined in Section 65 of the Consumer Rights Act 2015) of GP Bullhound LLP, or any of its respective affiliates, agents or employees, is not hereby excluded nor is damage caused by their fraud or fraudulent misrepresentation.

This research report should not be construed in any circumstances as an offer to sell or solicitation of any offer to buy any security or other financial instrument, nor shall they, or the fact of the distribution, form the basis of, or be relied upon in connection with, any contract relating to such action. The information contained in this research report has no regard for the specific investment objectives, financial situation or needs of any specific entity and is not a personal recommendation to anyone. Persons reading this research report should make their own investment decisions based upon their own financial objectives and financial resources and, if in any doubt, should seek advice from an investment advisor.

Past performance of securities is not necessarily a guide to future performance and the value of securities may fall as well as rise. In particular, investments in the technology sector may be subject to frequent fluctuations. The information contained in this research report is based on materials and sources that are believed to be reliable; however, they have not been independently verified and are not guaranteed as being accurate. The information contained in this research report is not intended to be a complete statement or summary of any securities, markets, reports or developments referred to herein.

This research report may contain forward-looking statements, which involve risks and uncertainties. Forward-looking information is provided for illustrative purposes only and is not intended to serve as, and must not be relied upon as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions.

Any and all opinions expressed are current opinions as of the date appearing on the documents included in this research report.

The information contained in this research report should not be relied upon as being an independent or impartial view of the subject matter and for the purposes of the rules and guidance of the Financial Conduct Authority (“the FCA”) this research report is a marketing communication and a financial promotion.

Accordingly, its contents have not been prepared in accordance with legal requirements designed to promote the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

The individuals who prepared the information contained in this research report may be involved in providing other financial services to the company or companies referenced in this research report or to other companies who might be said to be competitors of the company or companies referenced in this research report. As a result, both GP Bullhound LLP and the individual members, directors, officers and/ or employees who prepared the information contained in this research report may have responsibilities that conflict with the interests of the persons who access this research report.

GP Bullhound LLP and/or connected persons may, from time to time, have positions in, make a market in and/ or effect transactions in any investment or related investment mentioned in this research report and may provide financial services to the issuers of such investments. The information contained in this research report or any copy of part thereof should not be accessed by a person in any jurisdictions where its access may be restricted by law and persons into whose possession the information in this research report comes should inform themselves about, and observe, any such restrictions. Access of the information contained in this research report in any such jurisdictions may constitute a violation of UK or US securities law, or the law of any such other jurisdictions. Neither the whole nor any part of the information contained in this research report may be duplicated in any form or by any means. Neither should the information contained in this research report, or any part thereof, be redistributed or disclosed to anyone without the prior consent of GP Bullhound LLP. GP Bullhound LLP and/or its associated undertakings may from time-to-time provide investment advice or other services to, or solicit such business from, any of the companies referred to in the information contained in this research report.

Accordingly, information may be available to GP Bullhound LLP that is not reflected in this material and GP Bullhound LLP may have acted upon or used the information prior to or immediately following its publication. However, no person at GP Bullhound (which includes its members, directors, officers and/or employees), may undertake personal transactions in financial instruments of companies to which this research report relates, without receiving prior clearance from the GP Bullhound Compliance Officer or nominated delegated. In addition, GP Bullhound LLP, the members, directors, officers and/or employees thereof and/or any connected persons may have an interest in the securities, warrants, futures, options, derivatives or other financial instrument of any of the companies referred to in this research report and may from time-to-time add or dispose of such interests. GP Bullhound LLP is a limited liability partnership registered in England and Wales, registered number OC352636, and is authorised and regulated by the Financial Conduct Authority. Any reference to a partner in relation to GP Bullhound LLP is to a member of GP Bullhound LLP or an employee with equivalent standing and qualifications. A list of the members of GP Bullhound LLP is available for inspection at its registered office, 52 Jermyn Street, London SW1Y 6LX.

For US Persons: This research report is distributed to US persons by GP Bullhound Inc. a broker-dealer registered with the SEC and a member of the FINRA. GP Bullhound Inc. is an affiliate of GP Bullhound LLP. All investments bear certain material risks that should be considered in consultation with an investors financial, legal and tax advisors. GP Bullhound Inc. engages in private placement and mergers and acquisitions advisory activities with clients and counterparties in the Technology and CleanTech sectors.

US registered broker-dealer Eric Crowley beneficially owns <1% of the outstanding shares of Speechify, which is a subject company of the present research report.

In addition, the persons involved in the production of this research report certify that the views expressed in this research report accurately reflect their personal views about the subject securities or issuers, and that no part of their compensation was, or will be, directly or indirectly related to the specific views expressed in this report. As such, no person at GP Bullhound (including its members, directors, officers and/or employees) has received, or is authorized to accept, any inducement, whether monetary or in whatsoever form, in counterparty of promise to issue favorable research coverage for the companies to which this research report relates.

In the last twelve months, GP Bullhound LLP or an affiliate is or has been engaged as an advisor to and received compensation from, or has invested in the following companies mentioned in this report: Amazon, Apple, Asana Rebel, CareerFoundry, Cleanshelf, Customer Thermometer, Discord, Facebook, Fishbrain, Flexjobs, Glovo, HackerOne, Klarna, Lingoda, Match Group, Mubi, Oxbotica, Partnerize, PayPal, Pinkbike, Playtomic, RealVNC, Recruitee, Revolut, Salesforce, Signavio, Slack, Spotify, Unity Technologies, Vivino, and Whoop.