The individuals who prepared the information contained in this report may be involved in providing other financial services to the company or companies referenced in this report or to other companies who might be said to be competitors of the company or companies referenced in this report.

GP Bullhound, through its investment banking and asset management departments, does and seek to do business with companies which are, or may be covered in this report. As a result, both GP Bullhound and the individual members, directors, officers and/ or employees who prepared the information contained in this report may have responsibilities that conflict with the interests of the persons who access this report.

GP Bullhound and/or connected persons may, from time to time, have positions in, make a market in and/ or effect transactions in any investment or related investment mentioned in this report and may provide financial services to the issuers of such investments. The information contained in this report or any copy of part thereof should not be accessed by a person in any jurisdictions where its access may be restricted by law and persons into whose possession the information in this report comes should inform themselves about, and observe, any such restrictions. Access of the information contained in this report in any such jurisdictions may constitute a violation of UK or US securities law, or the law of any such other jurisdictions. Neither the whole nor any part of the information contained in this report may be duplicated in any form or by any means. Neither should the information contained in this report, or any part thereof, be redistributed or disclosed to anyone without the prior consent of GP Bullhound. GP Bullhound and/or its associated undertakings may from time to-time provide investment advice or other services to, or solicit such business from,any of the companies referred to in the information contained in this report. Accordingly, information may be available to GP Bullhound that is not reflected in this material and GP Bullhound may have acted upon or used the information prior to or immediately following its publication. However, no person at GP Bullhound (which includes its members, directors, officers and/or employees), may undertake personal transactions in financial instruments of companies to which this report relates, without receiving prior clearance from the GP Bullhound Compliance Officer or nominated delegated.

In addition, GP Bullhound, the members, directors, officers and/or employees thereof and/or any connected persons may have an interest in the securities, warrants, futures, options, derivatives or other financial instrument of any of the companies referred to in this report and may from time-to-time add or dispose of such interests. GP Bullhound Corporate Finance Ltd and GP Bullhound Asset Management Ltd are private limited companies registered in England and Wales, registered numbers 08879134 and 08869750 respectively, and are authorised and regulated by the Financial Conduct Authority.

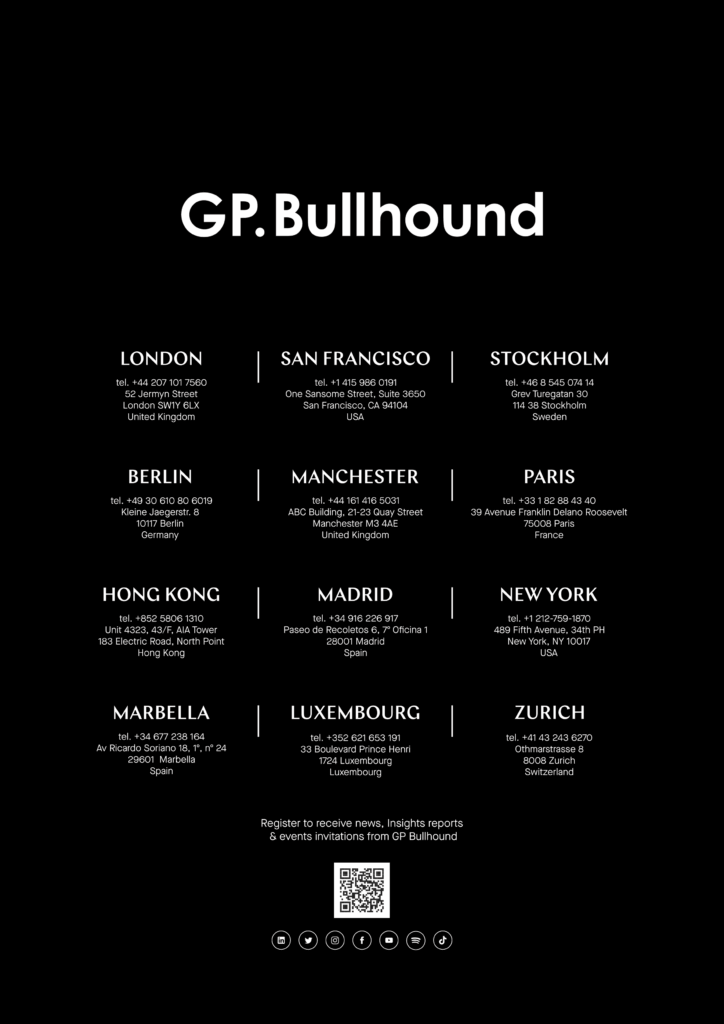

Any reference to a partner in relation to GP Bullhound is to a member of GP Bullhound or an employee with equivalent standing and qualifications. A list of the members of GP Bullhound is available for inspection at its registered office, 52 Jermyn Street, London SW1Y 6LX.

For US Persons: This report is distributed to US persons by GP Bullhound Inc. a broker-dealer registered with the SEC and a member of the FINRA. GP Bullhound Inc. is an affiliate of GP Bullhound Corporate Finance Ltd. All investments bear certain material risks that should be considered in consultation with an investors financial, legal and tax advisors. GP Bullhound Inc. engages in private placement and mergers and acquisitions advisory activities with clients and counterparties in the Technology and CleanTech sectors.

In addition, the persons involved in the production of this report certify that no part of their compensation was, or will be, directly or indirectly related to the specific views expressed in this report. As such, no person at GP Bullhound (including its members, directors, officers and/or employees) has received, or is authorized to accept, any inducement, whether monetary or in whatsoever form, in counterparty of promise to issue favorable coverage for the companies to which this report may relate.

GP Bullhound or an affiliate may have invested in or advised companies mentioned in this report in the past. For further information, please refer to https://www.gpbullhound.com/portfolio/ & and https://www.gpbullhound.com/investment-banking/.