The view

FROM GP BULLHOUND

MANISH MADHVANI

managing partner

alon kuperman

Iman crisby

executive director

marketing

marketing

executive director

JENNIFER ELLER

adam page

VICE PRESIDENT

RESEARCH

RESEARCH

VICE PRESIDENT

carlos de la esperanza

research analyst

analyst

maria lazareva

associate

julien lézé

The

star sector of the pandemic was

undoubtedly technology, helping the industry evolve from a period of

cross-examination over its influence and use of personal data

European tech companies stepped up and kept lives moving by providing

solutions for food delivery, ed-tech, med-tech, entertainment, home working,

and virtual conferences

The pressing need for essential services fuelled unprecedented

innovation, accelerating consumer adoption in many sub-sectors

by five years

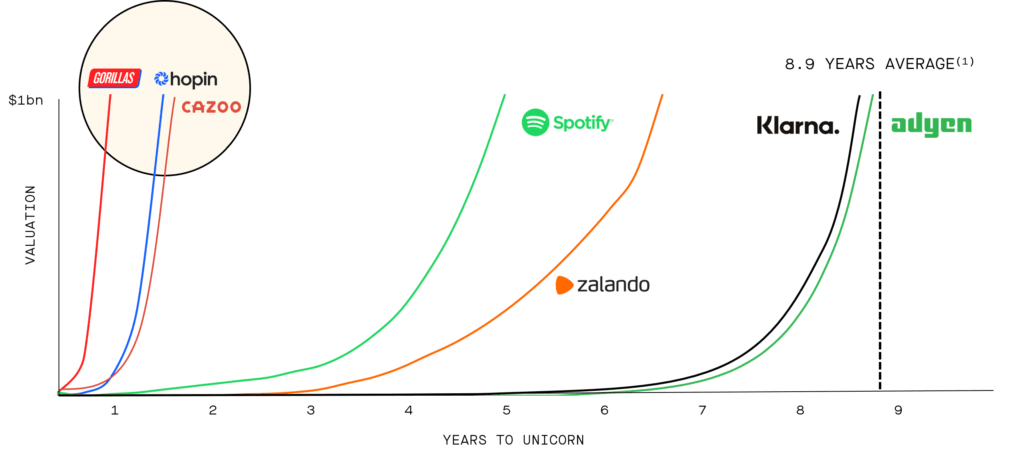

Mega-rounds with record investment in the sector have rapidly created

Unicorns, such as Gorillas (on-demand food delivery) in less than one year, as

well as Hopin

(virtual events) and Cazoo

(online car retailer)

The

$801bn ecosystem

52

companies became Unicorns this year, and over $382bn in value was created for

the tech ecosystem – staggeringly, in one year the increase in the combined value of Europe’s leading

tech companies nearly matched what it had taken 20 years previously to achieve

Since

we published our first report in 2014, the number

of billion-dollar companies has increased by over 5x and the ecosystem’s aggregate valuation

by 9x to around $801bn

57%

of all EU states have now created a Unicorn

THE CONSUMER COMES BACK

After

several years of Enterprise Software companies dominating the creation of new Unicorns, E-commerce and Marketplaces have seen a significant uptick, boosted

by mobility restrictions and the return of the consumer

The two sectors combined produced over double last year’s number of billion-dollar companies, with many next-gen food delivery companies meeting vast consumer demand

The two sectors combined produced over double last year’s number of billion-dollar companies, with many next-gen food delivery companies meeting vast consumer demand

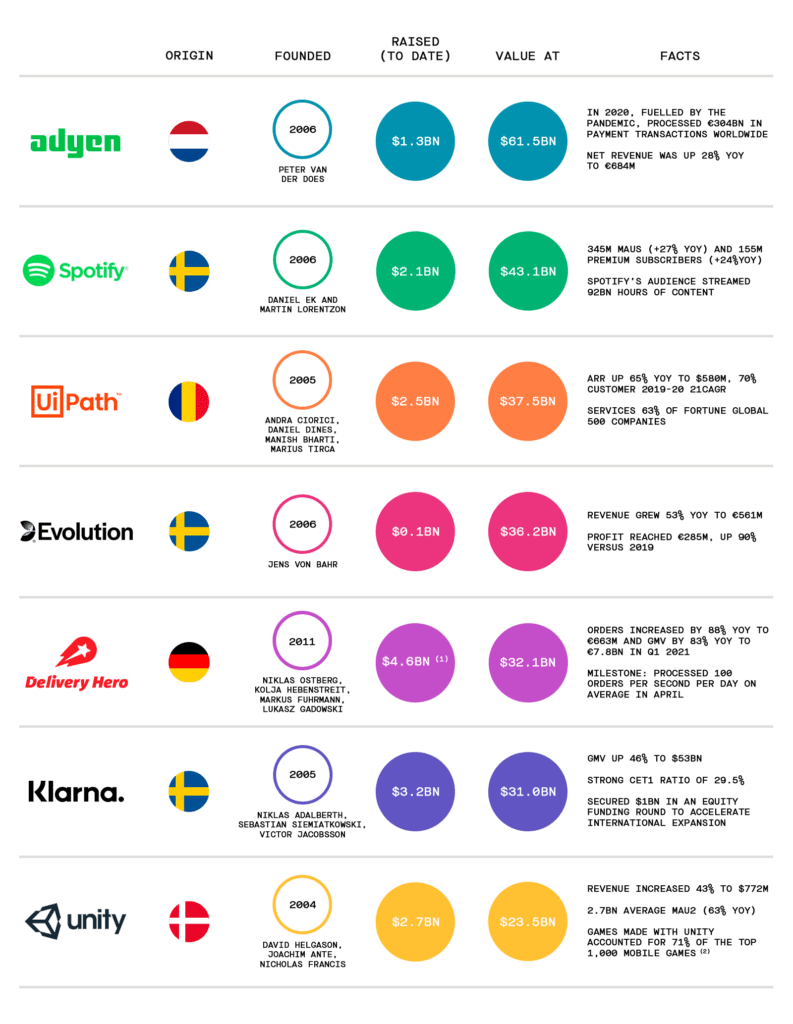

Europe creates its first tech Titan

-

Adyen

Fuelled

by activity in public markets, driving significant valuation increases across

the board, the Titans' club welcomes Adyen – Europe’s first tech company

founded since 2000 to be valued currently in excess of $50bn

A

step behind, Spotify broke into the $50bn group earlier this year, now valued at $43.1bn as of 12 May 2021

26 Titans walk the world today, with a significant number of new entrants given a wave of IPOs

The MISSING PUZZle PIECE

Capital

is no longer a constraint for European leaders, with the ecosystem growing

faster than ever as the availability of capital explodes

IPOs are a crucial part of the European ecosystem; of the 14 Unicorn IPOs in the past two years between Europe and the US, Europe accounted for a strong 57%

However, SPACs may negatively impact this balance with $100bn+ raised globally in 2021 and only $2.2bn of this raised in Europe - and many European tech leaders are now being acquired and targeted by US SPACs

IPOs are a crucial part of the European ecosystem; of the 14 Unicorn IPOs in the past two years between Europe and the US, Europe accounted for a strong 57%

However, SPACs may negatively impact this balance with $100bn+ raised globally in 2021 and only $2.2bn of this raised in Europe - and many European tech leaders are now being acquired and targeted by US SPACs

AUTHORS

For more information about the report, contact our authors by clicking on their image

This research report is provided for use by the intended recipient for information purposes only

It is prepared on the basis that the recipients are sophisticated investors with a high degree of financial knowledge

See the end of this report for full disclosures

This research report is provided for use by the intended recipient for information purposes only

It is prepared on the basis that the recipients are sophisticated investors with a high degree of financial knowledge

See the end of this report for full disclosures

20

years' worth of shareholder value created in one year

Pandemic

propels European ecosystem

20

years to reach $400bn+ ecosystem, nearly doubled in 2021

european tech outshining amid pandemic

With an ecosystem now worth

c.$801bn, 166 companies are valued over $1bn

The ecosystem’s value has grown by 9x since our first report in 2014

The ecosystem’s value has grown by 9x since our first report in 2014

The

European tech ecosystem is growing faster than ever as the availability of

capital swells

Valuations across the public and private markets have increased, and 52 new companies reached Unicorn status with a combined value of $94bn, a 1.6x uptick in the number of new billion-dollar companies versus 2020

Valuations across the public and private markets have increased, and 52 new companies reached Unicorn status with a combined value of $94bn, a 1.6x uptick in the number of new billion-dollar companies versus 2020

$380bn+ generated in just one year

Adyen has achieved Titan status (valued over $50bn), and the value of our cohort of

European tech billion-dollar companies is up 108% since the start of 2020,

outperforming the Nasdaq (+43%) and EURO STOXX (+7%)

Driven by increased availability of capital and a rapid increase in mega-rounds over $50m, the private markets are enjoying robust activity

Driven by increased availability of capital and a rapid increase in mega-rounds over $50m, the private markets are enjoying robust activity

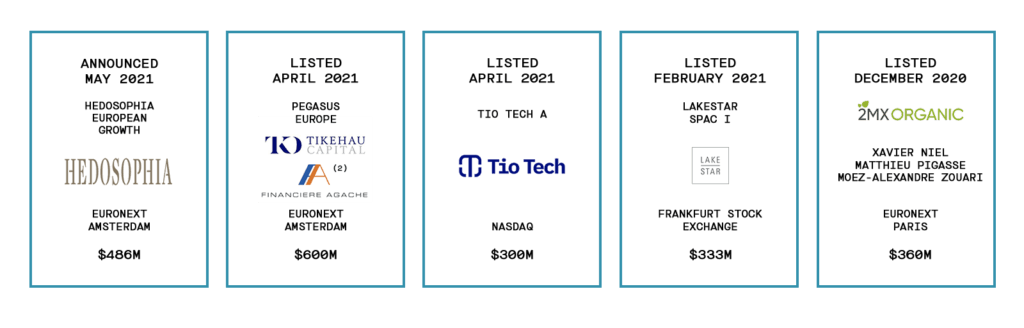

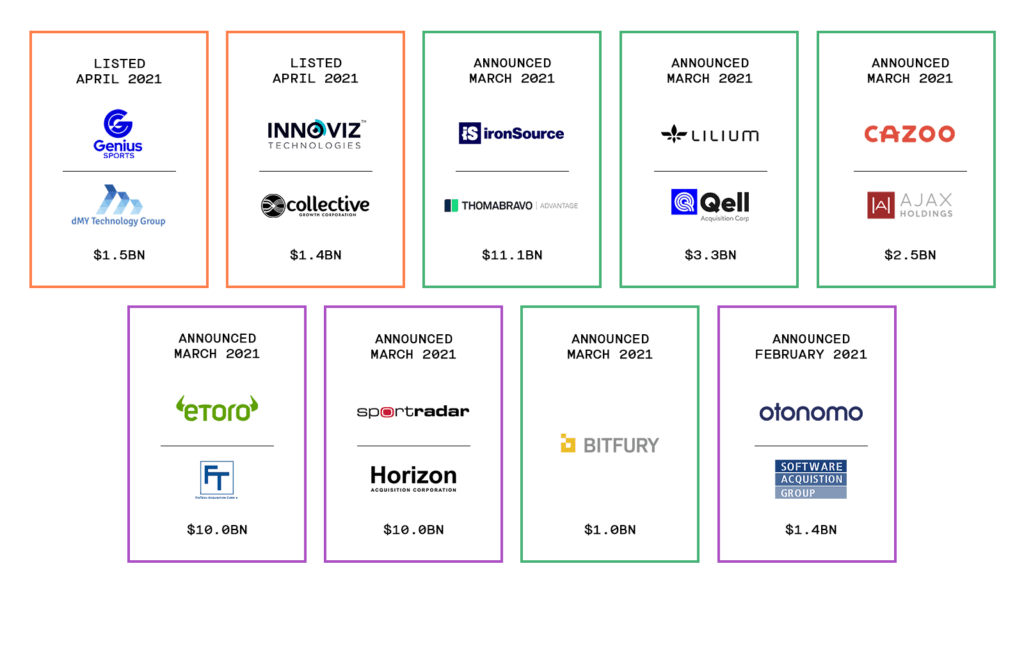

SPACs

are one of the hottest trends in the US, raising c.$230bn globally in new listings over the past year

European leaders are merging with US SPACs, but more European SPACs are being listed to keep the best of Europe in Europe

European leaders are merging with US SPACs, but more European SPACs are being listed to keep the best of Europe in Europe

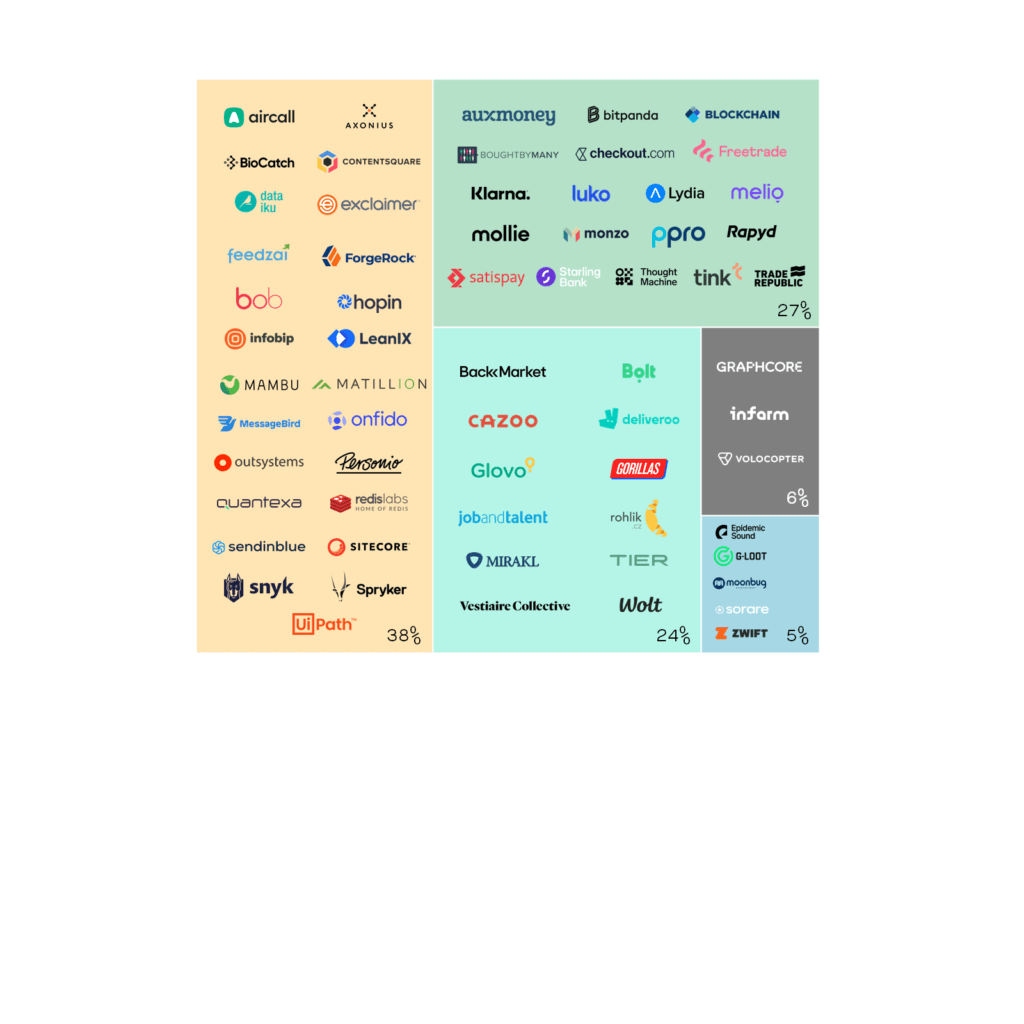

Enterprise

Software & Fintech continue to lead, but the return of the consumer minted

many new Unicorns in Marketplaces and E-commerce

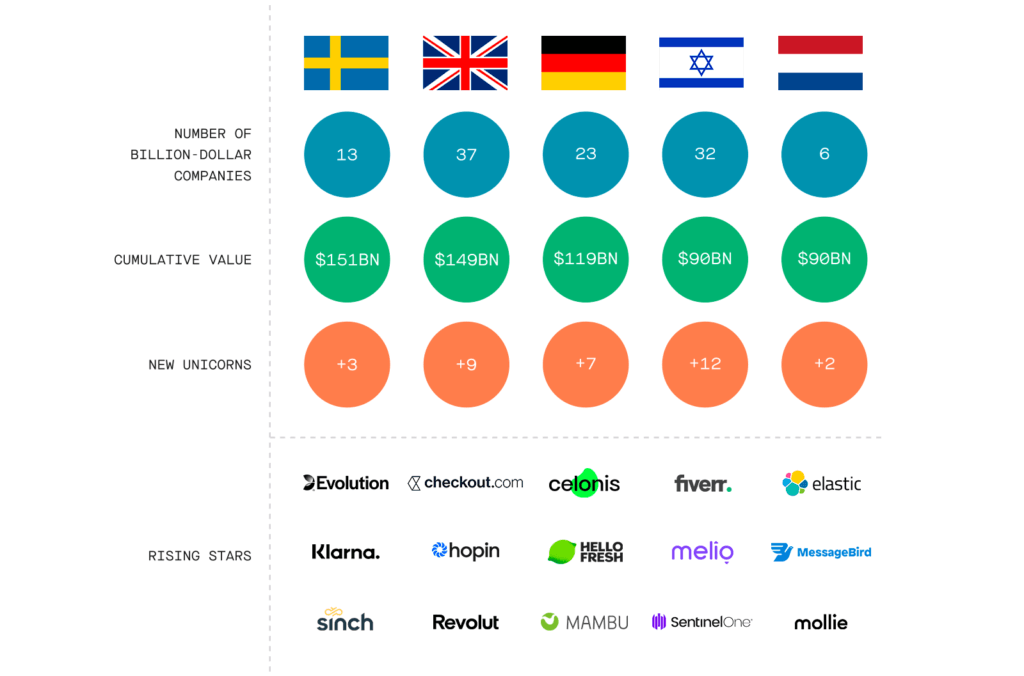

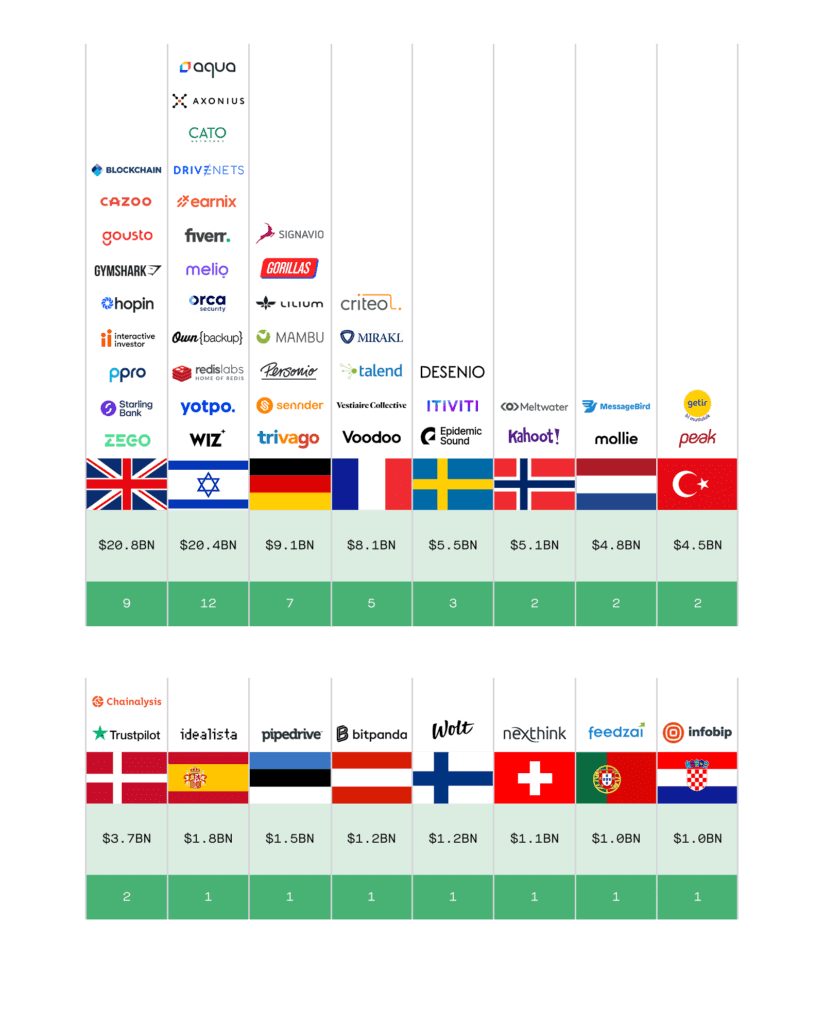

Sweden takes the pole position from the UK for cumulative value, and Germany and Israel are not far behind, not to mention the Unicorns from new geographies such as Croatia and Austria

Sweden takes the pole position from the UK for cumulative value, and Germany and Israel are not far behind, not to mention the Unicorns from new geographies such as Croatia and Austria

PUBLIC and PRIVATE MARKETS DRIVING GROWTH

SPACS NEXT STOP: EUROPE

RECORD ACTIVITY ACROSS SECTORS AND GEOS

The

lingo and journey to $50bn

A refresh on the terminology for

our report

GP Bullhound classifies the

companies featured in the Titans of Tech report into four key categories: Titans, Decacorns, Unicorns, and Contenders, based on their market valuation

All companies featured in this report were founded in 2000 or later

All companies featured in this report were founded in 2000 or later

Classification of companies by

valuation

Note: For full methodology, please see the end of this report

18 Decacorns in Europe

The number of billion-dollar companies

has increased by over 5x and the ecosystem

is worth around $801bn, almost 9x the aggregate valuation,

versus 2014

Technology sector thriving in the

pandemic

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

52 new billion-dollar companies

Cumulative value of $94bn

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

IN: 48

re-entry: 4

All

previously

publicly listed Unicorns where the market capitalisation has risen

above

$1bn

Unicorn

status in less than one year

Time taken to reach

billion-dollar valuation

While

some businesses have been hit worse by the pandemic, others have managed to

grow and close mega funding rounds to fuel their ambitions

In this year’s cohort of new billion-dollar companies, we note several start-ups that have achieved this status in record time

In this year’s cohort of new billion-dollar companies, we note several start-ups that have achieved this status in record time

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021; 1) 2021 new billion-dollar company cohort average

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021; 1) 2021 new billion-dollar company cohort average

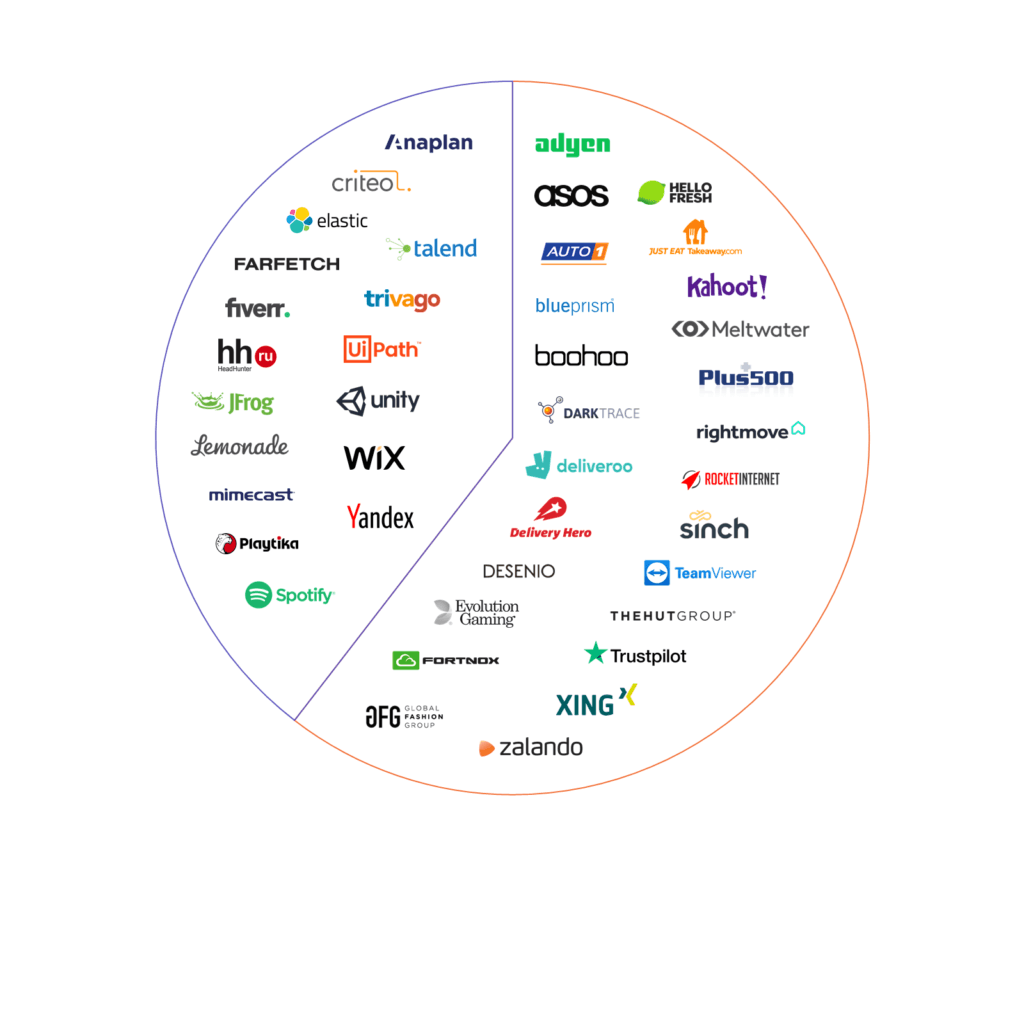

20 years' worth of value created in 2021 alone

$380BN+ increase

in aggregate valuation in 2021

Material step-up versus 2020, with more than 52 companies

joining the club and over c.$382bn in value created

The pandemic is driving public market gains for listed European tech leaders

Private markets remain strong, with a hive of activity as the availability of capital swells

The pandemic is driving public market gains for listed European tech leaders

Private markets remain strong, with a hive of activity as the availability of capital swells

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press releases, and GP Bullhound analysis.

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021Europe's leading public tech companies

Public billion-dollar companies

by valuation

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Sinch, Elastic, and Allfunds valuations rounded; cut-off date for inclusion in report 31 March 2021; and valuations correct as of 12 May 2021

Note: Sinch, Elastic, and Allfunds valuations rounded; cut-off date for inclusion in report 31 March 2021; and valuations correct as of 12 May 2021

Of the total billion-dollar companies in

Europe,

publicly held companies account for:

publicly held companies account for:

25%

59%

by number

Becomes a titan with valuation above $50bn

14

reached $10bn+ valuation

By value

Europe

staging IPO comeback

Europe versus

the

US: The

battleground

for tech IPOs

Europe

is

succeeding

in the battle to attract and retain technology companies,

with

60% of the 42 public companies in

our cohort listed in Europe

There have been 14 tech IPOs in our cohort in the last two years, of which 57% were in Europe; however, size still matters, with those listing in the US larger on average based on valuations as of 12 May 2021

There have been 14 tech IPOs in our cohort in the last two years, of which 57% were in Europe; however, size still matters, with those listing in the US larger on average based on valuations as of 12 May 2021

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Current split of 42 public

billion-dollar companies between Europe & the US

14 IPOs in Last two Years

us

40%

europe

us

8 (57%)

average value

$5bn

$13bn

average value

6 (43%)

europe

60%

Public European tech outperforming

Share price performance of public

billion-dollar companies

The Technology sector has proven its resilience, outperforming amid the COVID-19 pandemic

The European cohort of public

billion-dollar companies is outperforming major indices,

including Nasdaq

including Nasdaq

Source:

Capital IQ

Note: Performance is based on the share price performance of all 42 publicly listed tech companies, indexed to 100 between 2 January 2020 and 12 May 2021; calculated on an unweighted basis

Note: Performance is based on the share price performance of all 42 publicly listed tech companies, indexed to 100 between 2 January 2020 and 12 May 2021; calculated on an unweighted basis

+108%

european tech

billion-dollar cohort

billion-dollar cohort

+43%

+7%

NASDAQ

EURO STOXX

Europe’s

leading privately held tech companies

Private billion-dollar companies ranked by valuation

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

30%

By number

40

Have reached a $5bn+ valuation

New billion-dollar companies

9

By value

62%

Of the total billion-dollar companies in

Europe, privately held companies account for:

0

Europe’s

leading acquired tech companies

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Acquired billion-dollar companies

by valuation

Of the total billion-dollar companies in Europe,

acquired companies account for:

acquired companies account for:

11%

13%

By number

By value

3

Acquired for more than

$5bn+ valuation

$5bn+ valuation

Newly-acquired

$1bn companies

$1bn companies

6

SPACs

targeting European tech leaders

The hottest investment trend in

the US comes to Europe

SPACs

are one of the hottest trends in the US and Asia, a large proportion of which are tech-focused

While accounting for

nearly $230bn raised globally in new

listings over the past year, they have garnered little traction in Europe, until today 1

Following strong activity in the US, a growing number of European leaders are merging with US SPACs, but an increasing number of SPACs are being listed in Europe

Following strong activity in the US, a growing number of European leaders are merging with US SPACs, but an increasing number of SPACs are being listed in Europe

Source:

Bloomberg, Business Wire, CNBC, Financial Times, Reuters, Seeking Alpha,

TechCrunch, press releases, and GP Bullhound Analysis

Note:1) Thomas, D., Kruppa, M. (11 May 2021). ‘British Spac king plans first European blank cheque listing’, FT.com; 2) Holding company controlled by Bernard Arnault and Jean Pierre Mustier

Note:1) Thomas, D., Kruppa, M. (11 May 2021). ‘British Spac king plans first European blank cheque listing’, FT.com; 2) Holding company controlled by Bernard Arnault and Jean Pierre Mustier

EUROPEAN BILLION-DOLLAR COMPANIES ACQUIRED BY SPACS

SPACS RECENTLY LISTED IN EUROPE

Unprecedented

activity across all sectors

European billion-dollar

companies by sector

Building on 2020, the number of billion-dollar Enterprise Software & Fintech

companies is growing

We are seeing the return of the consumer, with Marketplaces and E-commerce models back in focus

We are seeing the return of the consumer, with Marketplaces and E-commerce models back in focus

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; 1) Includes re-entries: Global Fashion Group (E-commerce), Criteo (Software), Talend (Software) and Trivago (Marketplaces)

Note: Cut-off date for inclusion in report 31 March 2021; 1) Includes re-entries: Global Fashion Group (E-commerce), Criteo (Software), Talend (Software) and Trivago (Marketplaces)

Number of billion-dollar

companies by sector

Introducing

The new kids on the block

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press releases, public information, company websites, and GP Bullhound analysis

SILVIO KUTIC

CEO of Infobip

From the start, I wanted to create a communications

platform that built bridges and forged meaningful connections between companies

and customers, and people and things. At the time, the idea of the Internet of

Things was not even a viable concept.

I knew that the answer lay in computing and computer science, and that it was just a matter of time while engineers and developers tested different concepts to discover new technical capabilities. Today we continue to function in this continuous learning loop, and we have not even scratched the surface – we are just starting.

Everything Infobip has done over the past c.15 years has been aimed at creating the best possible online, mobile, or digital experiences for customers and always at the edge of innovation, and we positioned ourselves as a platform that connects B2C and customers to things (even before 'things' existed).

Customers today have expectations that have led to the commoditisation of connectivity. They are device and channel-agnostic, and today's younger generations have only ever known the touchscreen as a user interface. At Infobip, we saw that the value of individual communications services would come to the fore only when they could be bundled together. We set about becoming truly omnichannel on a global scale by providing engagement, identity, user authentication, security and now marketing automation as well as a contact centre.

I knew that the answer lay in computing and computer science, and that it was just a matter of time while engineers and developers tested different concepts to discover new technical capabilities. Today we continue to function in this continuous learning loop, and we have not even scratched the surface – we are just starting.

Everything Infobip has done over the past c.15 years has been aimed at creating the best possible online, mobile, or digital experiences for customers and always at the edge of innovation, and we positioned ourselves as a platform that connects B2C and customers to things (even before 'things' existed).

Customers today have expectations that have led to the commoditisation of connectivity. They are device and channel-agnostic, and today's younger generations have only ever known the touchscreen as a user interface. At Infobip, we saw that the value of individual communications services would come to the fore only when they could be bundled together. We set about becoming truly omnichannel on a global scale by providing engagement, identity, user authentication, security and now marketing automation as well as a contact centre.

Expert view

We have been profitable since the moment we started, and we have grown organically, ploughing all profit back into the business. For the first time since inception, we took outside investment in July 2020, raising more than $200m from One Equity Partners. We are now ready to use M&A as our strategic toolset and drive further consolidation within the CPaaS industry by acquiring complementary businesses – the first being OpenMarket.

This deal brings two world-class companies under the same ownership to form an important competitor in cloud communications, with a revenue runrate of more than $1.2bn. Its scale in the US, alongside our strengths outside, enable the US business to process more than 14bn monthly customer interactions across the full range of communication channels, in more than 190 countries around the globe. Together we have more than 10,000 customers, including many of the world’s leading enterprises who will benefit from best-in-class direct connectivity to more than 650 mobile operators and omnichannel cloud-based messaging and SaaS offerings.

In line with the largest competitors in this space recently engaging in major M&A activities, we are looking to grow exponentially in preparation for a future IPO. Our vision is to accelerate Infobip’s pre-IPO growth primarily in North America but also globally by executing a series of identified strategic acquisitions together with organic growth and a focus on GTM through strategic partnerships.

I believe we are headed towards a new era – which we call ‘Interaction 4.0’ – replacing the need to browse the web or download an app with conversational interaction as the heart of communication. But we cannot do this alone. Rather than disrupting, we are entering an age of collaboration. It is going to take some partnering and channel work to get these types of cutting-edge capabilities into the critical category and away from the commodity mindset - just like we did during the pandemic. ‘Interaction 4.0’ will move communications towards conversational user interfaces, and we plan on being at the forefront of this era.

This deal brings two world-class companies under the same ownership to form an important competitor in cloud communications, with a revenue runrate of more than $1.2bn. Its scale in the US, alongside our strengths outside, enable the US business to process more than 14bn monthly customer interactions across the full range of communication channels, in more than 190 countries around the globe. Together we have more than 10,000 customers, including many of the world’s leading enterprises who will benefit from best-in-class direct connectivity to more than 650 mobile operators and omnichannel cloud-based messaging and SaaS offerings.

In line with the largest competitors in this space recently engaging in major M&A activities, we are looking to grow exponentially in preparation for a future IPO. Our vision is to accelerate Infobip’s pre-IPO growth primarily in North America but also globally by executing a series of identified strategic acquisitions together with organic growth and a focus on GTM through strategic partnerships.

I believe we are headed towards a new era – which we call ‘Interaction 4.0’ – replacing the need to browse the web or download an app with conversational interaction as the heart of communication. But we cannot do this alone. Rather than disrupting, we are entering an age of collaboration. It is going to take some partnering and channel work to get these types of cutting-edge capabilities into the critical category and away from the commodity mindset - just like we did during the pandemic. ‘Interaction 4.0’ will move communications towards conversational user interfaces, and we plan on being at the forefront of this era.

We have been profitable since the moment we started, and we have grown organically, ploughing all profit back into the business

2021

UNICORN

We recently won the ‘COVID-19 Mobile Response’ category in the Mobile Ecosystem Forum’s Meffy Awards

Infobip has gone through the pandemic unscathed. We were able to help new and existing customers manage the overnight shift to digital. We also hired over 500 people, built a new HQ in Zagreb, and acquired a business that brings 300 more skilled specialists into the business.

We are most proud of our pro bono work with the public sector, helping authorities build simple, self-service chatbots to provide critical information to citizens in search of fast guidance around Covid and reliable delivery of critical information. Infobip’s FAQ chatbot has been used by over 45 health organisations across the world to provide up-to-date, trustworthy advice over WhatsApp about the pandemic. Recently we won the ‘COVID-19 Mobile Response’ category in the Mobile Ecosystem Forum’s Meffy Awards.

It has also been ground-breaking to achieve unicorn status in Croatia, and it is a sign for the global investment community that substantial growth on a global scale can be achieved by other Croatian companies. For international investment, the internet can only take you so far – authentic experiences are better in person. Seeing first-hand the culture, consumers, and businesses gives the insight necessary for a disciplined investment approach. At some point, we will be allowed to do this again safely.

We are most proud of our pro bono work with the public sector, helping authorities build simple, self-service chatbots to provide critical information to citizens in search of fast guidance around Covid and reliable delivery of critical information. Infobip’s FAQ chatbot has been used by over 45 health organisations across the world to provide up-to-date, trustworthy advice over WhatsApp about the pandemic. Recently we won the ‘COVID-19 Mobile Response’ category in the Mobile Ecosystem Forum’s Meffy Awards.

It has also been ground-breaking to achieve unicorn status in Croatia, and it is a sign for the global investment community that substantial growth on a global scale can be achieved by other Croatian companies. For international investment, the internet can only take you so far – authentic experiences are better in person. Seeing first-hand the culture, consumers, and businesses gives the insight necessary for a disciplined investment approach. At some point, we will be allowed to do this again safely.

Champion’s

league

Billion-dollar stables

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

The UK has lost the pole position for the first time to Sweden

Sweden has overtaken the UK by value thanks to significant valuation uplifts for core companies Klarna, Spotify, and Evolution Gaming, which, combined, represent c.73% of Sweden's cumulative value in 2021, despite its population size

Swedish companies must think about international expansion much earlier on in their development given the small home market

View our full list of Unicorns in sections 2.6, 2.9 and 2.10

Europe’s

tech factories

The UK generated the largest cumulative value of new unicorns, but not the highest number, adding nine with a combined value of $20.8bn

Israel confirmed its position as a Unicorn factory, especially in the Enterprise Software space, where the country added 12 new Unicorns in the past year

Israel confirmed its position as a Unicorn factory, especially in the Enterprise Software space, where the country added 12 new Unicorns in the past year

New billion-dollar companies by

geography

New billion-dollar companies in

2021

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Expert view

Interactive Investor

set out to challenge the traditional investment platform model of increasing

fees as your wealth increases. As the only scaled subscription-based investment

platform in the UK, we charge a flat fee rather than a percentage so that

investors keep more of their money. Our service is straightforward and as your

wealth grows, you keep more of it.

Interactive Investor is focused on the mass affluent consumer, and we are very compelling for those with £20,000 plus to invest. Our targeted segment has not been affected by the emergence of neo-traders or robo-advisors given their limited offerings, the laws in Europe, and the typical UK consumer behaviour. Most of our clients come from outside the platform space as they realise they can get largely the same offering at a fraction of the price if they move their assets to our platform. For example, a 38-year-old customer that has their pension with Interactive Investor versus Standard Life until their normal retirement age could save £94,000 in fees.

We believe there has been a fundamental shift in the long-term savings market as people take control of their finances, and the pandemic has accelerated this. We expect to continue benefitting from this cultural shift, as well as our increased efforts on the brand and marketing side in recent years that has re-positioned us as a premium brand. As people take their medium- and long-term financial futures into their own hands, we are seeing a greater degree of engagement, and a substantial increase in ISA and SIPP accounts.

Moreover, with our growing attraction in pensions, we are seeing substantially increased traction in inbound business from traditional insurance companies. At the same time, we see a progressive increase in the share of investing in international markets as opposed to domestic markets, which has been particularly positive for us as we are the only scale platform that provides efficient, direct access to global markets and is multi-currency.

Interactive Investor is focused on the mass affluent consumer, and we are very compelling for those with £20,000 plus to invest. Our targeted segment has not been affected by the emergence of neo-traders or robo-advisors given their limited offerings, the laws in Europe, and the typical UK consumer behaviour. Most of our clients come from outside the platform space as they realise they can get largely the same offering at a fraction of the price if they move their assets to our platform. For example, a 38-year-old customer that has their pension with Interactive Investor versus Standard Life until their normal retirement age could save £94,000 in fees.

We believe there has been a fundamental shift in the long-term savings market as people take control of their finances, and the pandemic has accelerated this. We expect to continue benefitting from this cultural shift, as well as our increased efforts on the brand and marketing side in recent years that has re-positioned us as a premium brand. As people take their medium- and long-term financial futures into their own hands, we are seeing a greater degree of engagement, and a substantial increase in ISA and SIPP accounts.

Moreover, with our growing attraction in pensions, we are seeing substantially increased traction in inbound business from traditional insurance companies. At the same time, we see a progressive increase in the share of investing in international markets as opposed to domestic markets, which has been particularly positive for us as we are the only scale platform that provides efficient, direct access to global markets and is multi-currency.

Interactive investor

Richard wilson, CEO

Barry Bicknell, CFO

Interactive Investor is focused on the mass affluent consumer, and we are very compelling for those with £20,000 plus to invest

2021 unicorn

Interactive Investor has faced many challenges with the pandemic, and a lot of growth as well. In a time of market volatility and thus activity, with all of our top trading days being in the last nine months and record trading volumes, we focused on maintaining customer service while our staff switched to remote working overnight, including our contact centre. At the same time our extraordinary team continued to focus on engineering to support our new breakthrough tech this year, executed multiple acquisitions and divestments simultaneously, and in recent months have hired over 200 people.

Today we have approached 20% of the market, having acquired all the available mid-sized platforms in the UK. Our organic AUA inflow increased from £1.8bn in 2019 to £4.3bn in 2020. In the same period, our client acquisition increased from 15,000 to 42,000. This uplift in inflows and clients, and particularly in our wrap accounts that are gaining momentum, has continued into 2021.

When it comes to M&A, we focus on execution and delivery. In our experience, it is key to not make too many assumptions, but to listen closely and make clear decisions, and execute only what you know you can do. We work hard to keep our operating model clean and efficient so that we can move at pace to make it the best in the market. What is more, our investors provide sector and industry knowledge, and challenge us in terms of strategy and the shape of our offering.

We have three main areas of focus moving forward: 1) Pension penetration, capitalising on the some £800bn UK market; 2) referral networks, focusing on the family networks with family-based solutions and using our subscription model as a bundling opportunity; and 3) continuously finetuning our personalisation of service.

Today we have approached 20% of the market, having acquired all the available mid-sized platforms in the UK. Our organic AUA inflow increased from £1.8bn in 2019 to £4.3bn in 2020. In the same period, our client acquisition increased from 15,000 to 42,000. This uplift in inflows and clients, and particularly in our wrap accounts that are gaining momentum, has continued into 2021.

When it comes to M&A, we focus on execution and delivery. In our experience, it is key to not make too many assumptions, but to listen closely and make clear decisions, and execute only what you know you can do. We work hard to keep our operating model clean and efficient so that we can move at pace to make it the best in the market. What is more, our investors provide sector and industry knowledge, and challenge us in terms of strategy and the shape of our offering.

We have three main areas of focus moving forward: 1) Pension penetration, capitalising on the some £800bn UK market; 2) referral networks, focusing on the family networks with family-based solutions and using our subscription model as a bundling opportunity; and 3) continuously finetuning our personalisation of service.

Sector insights

Consumer CATAPULTS

E-commerce & Marketplaces

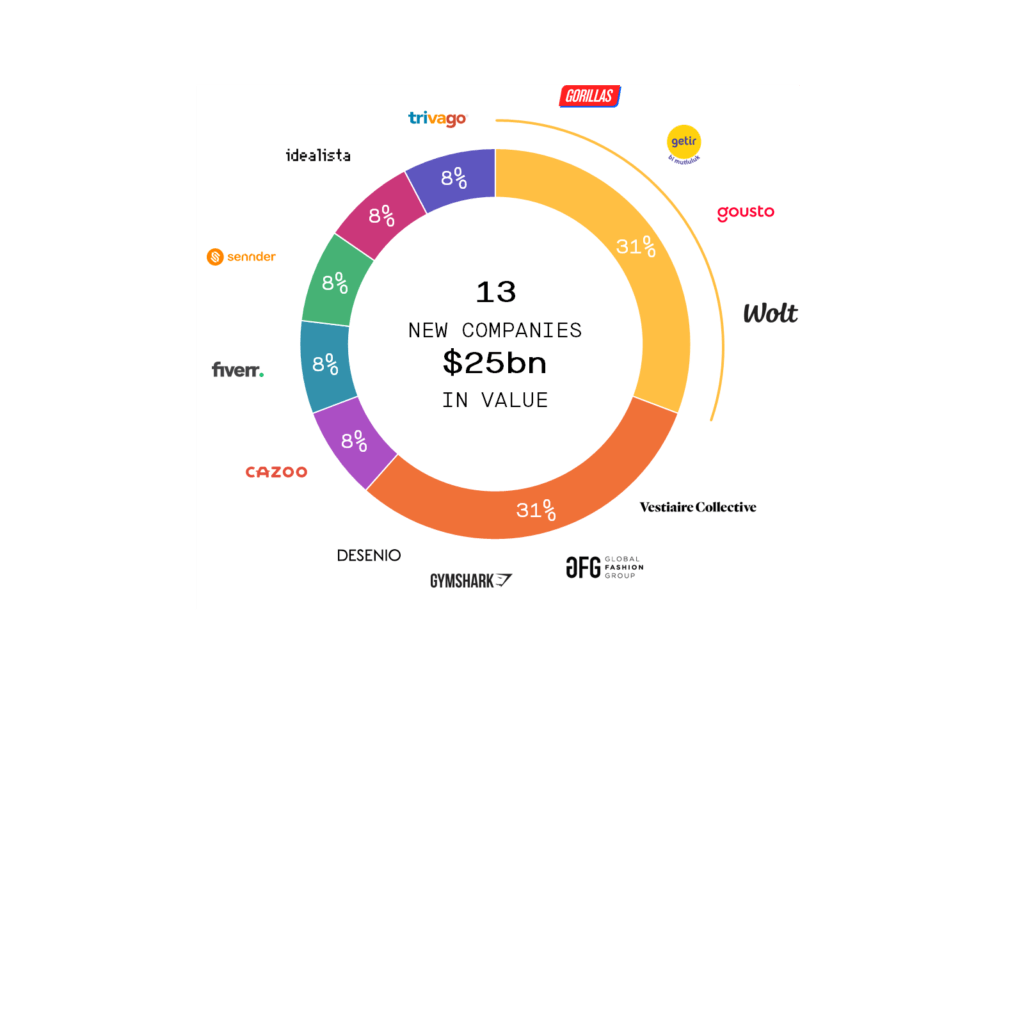

The return of the consumer led to a

record 13 new Unicorns for these sectors combined, bolstered by on-demand

start-ups

The leap of c.2x more billion-dollar companies from 2020 was pandemic-driven

The leap of c.2x more billion-dollar companies from 2020 was pandemic-driven

On-demand appetite in overdrive

Billions have been invested in this

growing ecosystem during the pandemic

Food delivery dominates, faster and better than ever, but this is just the start of what’s to come for ‘I want it now’

Food delivery dominates, faster and better than ever, but this is just the start of what’s to come for ‘I want it now’

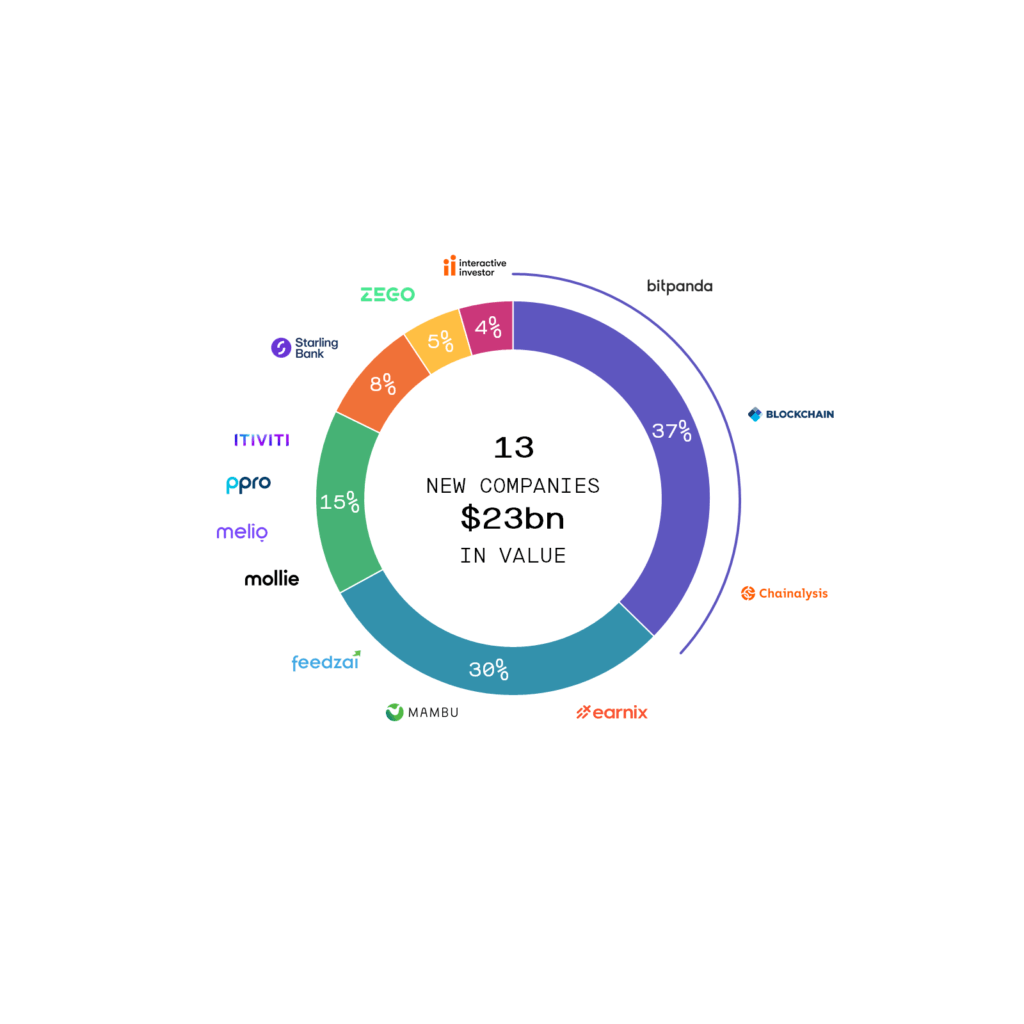

Noteworthy investments this year have

pushed the combined value our billion-dollar cohort of European

companies

to

$23bn

The space is maturing, with category leaders showing a path towards mainstream adoption

The space is maturing, with category leaders showing a path towards mainstream adoption

Crypto on doorstep of mainstream

The critical point for

crypto

Further acceptance

of

cryptocurrencies

within

financial

services

means a future wave of new support products and services

Challenges remain to reach mainstream, such as the ecosystem’s image, energy consumption, and regulation

Challenges remain to reach mainstream, such as the ecosystem’s image, energy consumption, and regulation

E-commerce

& Marketplaces reach new heights;

spotlight on crypto

spotlight on crypto

Return

of the consumer

E-commerce and Marketplaces delivered

13 new

additions to the billion-dollar club this year, up c.2x versus 2020

On-demand start-ups are raising the bar for urban logistics, investing in dark store networks to bring consumer goods to customers’ doorsteps in as little as 10 minutes

On-demand start-ups are raising the bar for urban logistics, investing in dark store networks to bring consumer goods to customers’ doorsteps in as little as 10 minutes

Split of new E-commerce & Marketplaces

billion-dollar

companies

by

number

Source: Capital IQ, Mergermarket,

Pitchbook, Crunchbase, press releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021. Cut-off date for capital raised as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021. Cut-off date for capital raised as of 12 May 2021

E-commerce & Marketplaces powered by pandemic

Expert view

Over 12 years ago, after

graduating from fashion school and working in marketing in France, I realised I

felt uninspired by the fashion industry. It had dramatically evolved in

the past 15-20 years, with fast fashion taking over and affecting consumer

trends. Drugged by novelties and influenced by social media, consumers were

trapped in a vicious cycle to get the newest items. This

over-consumption led to ‘closet waste’, something we’re probably all familiar

with, where there were excessive amounts of clothing sitting unused in our

closets. I wanted to give a second life to those items.

Seeing a gap in the market for a trustworthy, curated, fashion-focused resale platform, my co-founders and I created Vestiaire Collective in October 2009. We quickly realised that international expansion was key for supply, so we expanded throughout Europe, then to the US, and most recently into APAC, where we expect to launch in Korea at end-2021.

Vestiaire Collective has a few crucial parts that make it very special. The first is curation. We select items from more than 20,000 submitted each day by our sellers and check them for authenticity. Once the item has been sold on the platform, it is sent to our second jewel, our warehouses across the world.

Here, teams of Vestiaire Academy-trained experts inspect items for compliance in terms of quality and authenticity. Finally, the item is shipped to the buyer. In 2012, we signed an anti-counterfeiting charter with the French government, enabling us to work hand-in-hand with the world’s most prestigious luxury fashion houses and, as a result, today we have very strong brand collaborations behind the scenes.

Seeing a gap in the market for a trustworthy, curated, fashion-focused resale platform, my co-founders and I created Vestiaire Collective in October 2009. We quickly realised that international expansion was key for supply, so we expanded throughout Europe, then to the US, and most recently into APAC, where we expect to launch in Korea at end-2021.

Vestiaire Collective has a few crucial parts that make it very special. The first is curation. We select items from more than 20,000 submitted each day by our sellers and check them for authenticity. Once the item has been sold on the platform, it is sent to our second jewel, our warehouses across the world.

Here, teams of Vestiaire Academy-trained experts inspect items for compliance in terms of quality and authenticity. Finally, the item is shipped to the buyer. In 2012, we signed an anti-counterfeiting charter with the French government, enabling us to work hand-in-hand with the world’s most prestigious luxury fashion houses and, as a result, today we have very strong brand collaborations behind the scenes.

FANNY MOIZANT

Vestiaire

Collective

2021

unicorn

unicorn

Vestiaire Collective was founded in the depths of the 2008-2009 recession, so we're used to thriving in times of crisis, and the pandemic has been no different. In 2020, we saw 100% YoY growth. Not only have people been stuck at home with more direct access to their closets and looking for ways to make money, but they have also completely re-evaluated how they consume, which has led to a focus on sustainability.

We are unbelievably passionate about this and have embedded sustainability into every aspect of what we do. We’re aiming to combat our emissions by reaching carbon neutrality by 2025. We discourage international shipping and offer direct shipping between sellers and buyers for items under €1,000. Moreover, through our marketing campaigns and algorithms, we suggest local products first, and we have strategies across the US, Europe and APAC to make sure that buyers are matched with sellers in their region, thus even further reducing carbon emissions and helping our members to think about the effects of their actions.

We also hope to educate our buyers and sellers with our ‘follow the leaf’ initiative, where we show the most sustainable options they can take on the app. On top of this, we launched the ‘fashion activist’ badge to encourage the community to be more circular, by not only buying or selling, but doing both - actively changing their consumption habits, and rewarding them for this. We continue to partner with high-profile fashion activists that are advocating for more sustainable behaviour. To further influence the fashion industry at large, we’re working with the UN, the World Economic Forum, and the Ellen MacArthur Foundation. We’ve recently joined the G7 Fashion Pact. And that’s just the tip of the iceberg.

We are unbelievably passionate about this and have embedded sustainability into every aspect of what we do. We’re aiming to combat our emissions by reaching carbon neutrality by 2025. We discourage international shipping and offer direct shipping between sellers and buyers for items under €1,000. Moreover, through our marketing campaigns and algorithms, we suggest local products first, and we have strategies across the US, Europe and APAC to make sure that buyers are matched with sellers in their region, thus even further reducing carbon emissions and helping our members to think about the effects of their actions.

We also hope to educate our buyers and sellers with our ‘follow the leaf’ initiative, where we show the most sustainable options they can take on the app. On top of this, we launched the ‘fashion activist’ badge to encourage the community to be more circular, by not only buying or selling, but doing both - actively changing their consumption habits, and rewarding them for this. We continue to partner with high-profile fashion activists that are advocating for more sustainable behaviour. To further influence the fashion industry at large, we’re working with the UN, the World Economic Forum, and the Ellen MacArthur Foundation. We’ve recently joined the G7 Fashion Pact. And that’s just the tip of the iceberg.

We select items from more than 20,000 submitted each day by our sellers

we want to bring our amazing community of 11m+ members and our own extremely passionate team - and empower them to change the world

The challenge to move our industry from linear to circular cannot be achieved with resale alone. But by growing the share of resale in the fashion industry, we can reduce production and items harming the planet, and put more pressure on fast fashion, which I believe is our biggest enemy. In our recent fundraising round, we announced a partnership with Alexander McQueen from Kering and Tiger Management as a first step to help the brand in reselling, and we look forward to working with more brands. We expect all brands to eventually have their own resale operations.

However, you cannot be sustainable if you forget the people along the way, so diversity is another major focus for us. This is a huge topic today, and when reaching Unicorn status in our recent fundraising, I was surprised to learn that I was one of the first female founders to achieve this in France. As we continue to grow, we have done a lot of quantitative and qualitative research on our own diversity. We have put the power back with our local teams, using our employee-led task forces’ roadmaps to achieve our goals.

As we continue to push forward with transforming the fashion industry, we want to bring our people - our amazing community of over 11m members as well as our own extremely passionate team - and empower them to change the world. Companies today are about more than profit. Where you work and where you shop is a reflection of your values. It’s time to make ourselves proud of our everyday decisions and work together for a better future.

However, you cannot be sustainable if you forget the people along the way, so diversity is another major focus for us. This is a huge topic today, and when reaching Unicorn status in our recent fundraising, I was surprised to learn that I was one of the first female founders to achieve this in France. As we continue to grow, we have done a lot of quantitative and qualitative research on our own diversity. We have put the power back with our local teams, using our employee-led task forces’ roadmaps to achieve our goals.

As we continue to push forward with transforming the fashion industry, we want to bring our people - our amazing community of over 11m members as well as our own extremely passionate team - and empower them to change the world. Companies today are about more than profit. Where you work and where you shop is a reflection of your values. It’s time to make ourselves proud of our everyday decisions and work together for a better future.

CO-FOUNDER & PRESIDENT

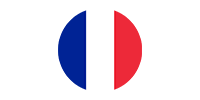

Demand

supercharged

Evolution of

on-demand food economy

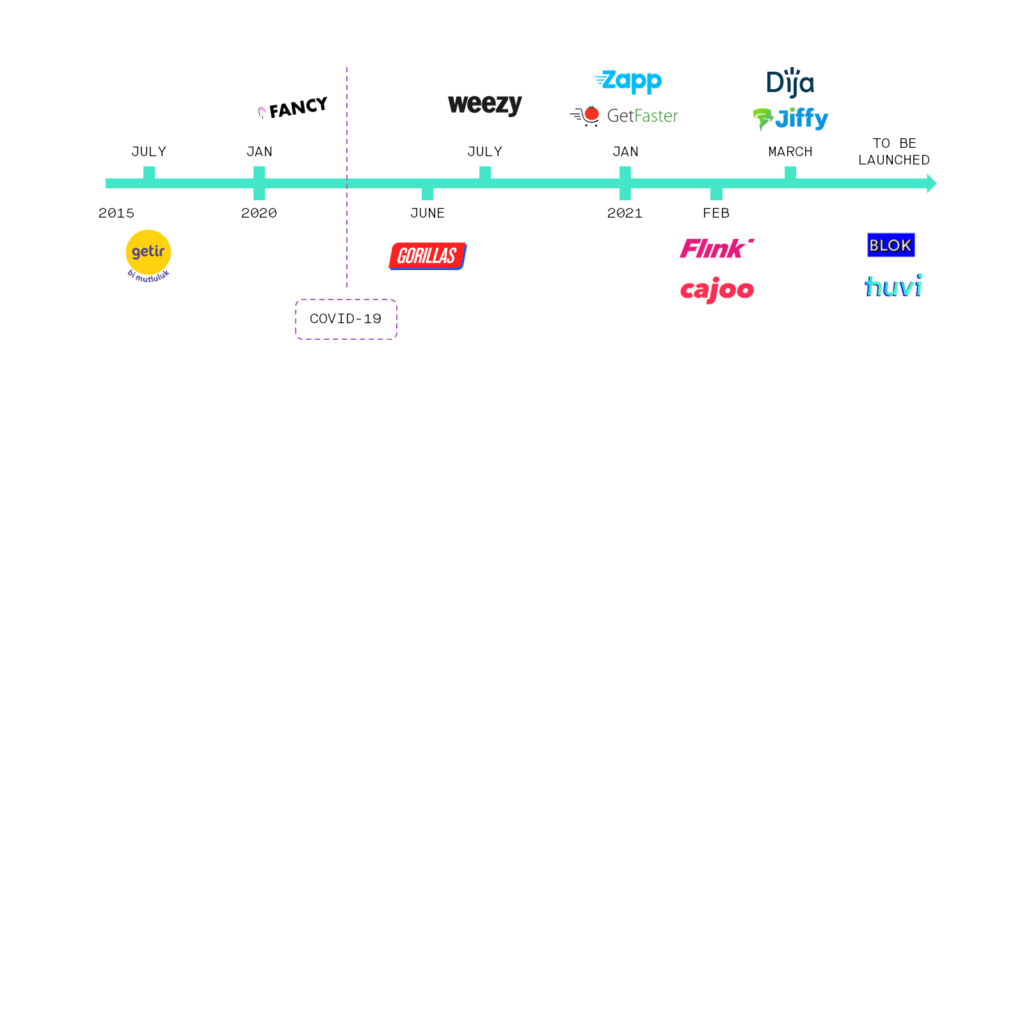

The pandemic has

revolutionised the food delivery sector and created vast opportunities for

start-ups

Investors have ploughed in over $14bn into rapid delivery apps, with more funding in Q1 2021 than the whole of 20201

On-demand grocery delivery Gorillas became a Unicorn in 10 months

Investors have ploughed in over $14bn into rapid delivery apps, with more funding in Q1 2021 than the whole of 20201

On-demand grocery delivery Gorillas became a Unicorn in 10 months

Faster and better: Evolution

of on-demand

economy

Wave of new on-demand start-ups

disrupting the market

Source: Capital IQ, Mergermarket,

Pitchbook, Crunchbase, and FT.com as of 12 May 2021

Note: 1) Bradshaw, T., Lee, D. (14 April 2021). ‘Catch them if you can: the $14bn rise of rapid grocery delivery services’, FT.com

Note: 1) Bradshaw, T., Lee, D. (14 April 2021). ‘Catch them if you can: the $14bn rise of rapid grocery delivery services’, FT.com

Miki Kuusi

Wolt

Ten

years ago when I started at university, I realised that we were living through this

kind of fourth industrial revolution, and I just knew I wanted to be a part of

it. Being involved in the European tech scene early on, it quickly became

evident that the future of every industry would inevitably become a mixture of online

and offline. Gaming was among the first to become a purely digital service with

music, entertainment and news quickly following. While we eat every day - and

restaurants are the biggest local service - I didn’t see anyone getting the

restaurant 'right' for this online world. Observing this shift towards online

and imagining what the future of eating was going to be like ultimately became

the inspiration behind Wolt.

When we founded Wolt in 2014, there wasn’t much of a food delivery scene to talk about. By 2016 we started seeing the industry spring up all around us. We saw companies that focused on delivery initially move towards working with restaurants. We were one of the few to start with the restaurant and end up with delivery. The key learning for me was that e-commerce and delivery go hand-in-hand. If you want to build a winning e-commerce service, you have to become a logistics company as well. And when you’re dealing with restaurants, you're dealing with hungry people - it’s all happening in real-time. That's why real-time logistics is the main feature of what we’re also building at Wolt.

The biggest hardship for us was to get our technology right as we started with a small and difficult home market in the Nordics. In this region, delivery was difficult to do and takeaway services were almost non-existent. Before we came to the scene most delivery services in the Nordics had the word 'pizza' in their name as that was close to the only food that was available for delivery at the time. The second challenge was ensuring that we could scale our product and operations on a tight budget when expanding; we focused on unit economics from day one and looked to optimise everything. We wanted to build a very product- and technology-focused company. We also saw restaurants as the gateway to other local services, but first, we needed to get this right with the restaurant.

When we founded Wolt in 2014, there wasn’t much of a food delivery scene to talk about. By 2016 we started seeing the industry spring up all around us. We saw companies that focused on delivery initially move towards working with restaurants. We were one of the few to start with the restaurant and end up with delivery. The key learning for me was that e-commerce and delivery go hand-in-hand. If you want to build a winning e-commerce service, you have to become a logistics company as well. And when you’re dealing with restaurants, you're dealing with hungry people - it’s all happening in real-time. That's why real-time logistics is the main feature of what we’re also building at Wolt.

The biggest hardship for us was to get our technology right as we started with a small and difficult home market in the Nordics. In this region, delivery was difficult to do and takeaway services were almost non-existent. Before we came to the scene most delivery services in the Nordics had the word 'pizza' in their name as that was close to the only food that was available for delivery at the time. The second challenge was ensuring that we could scale our product and operations on a tight budget when expanding; we focused on unit economics from day one and looked to optimise everything. We wanted to build a very product- and technology-focused company. We also saw restaurants as the gateway to other local services, but first, we needed to get this right with the restaurant.

Expert view

CO-FOUNDER AND CEO

If you want to build a winning e-commerce service, you have to become a logistics company as well

It was important to have a playbook for expansion very early on, as coming from such a small country, expansion was the only way for us to go. When expanding to a new country, we always have people on the ground first to understand life there – what are the restaurants like? Or the traffic? How do people get around in the city? There are a number of hyperlocal factors that you don't see in a traditional market analysis. But Covid challenged all of that. For the first time in our history, we’ve onboarded entire cities without having anyone even physically visit them. When Covid hit, we had around 700 employees, and we're over 3,000 today. That’s without accounting for the number of new restaurants and couriers we have onboarded.

The events of 2020 were a roller-coaster. Because we’re very country-specific in our approach, it’s been 23 roller-coasters, not just one. We’d always anticipated that delivery would go beyond restaurants, so the pandemic only accelerated the shift to other offerings, like groceries, pharmacy goods and electronics. Looking ahead, we’re going to continue expanding beyond the restaurant. We’re seeing a fundamental shift to online, but I don’t think the future of retail lies in a remote Amazon warehouse and a 24-hour delivery service. The future of retail is a distributed network of small warehouses within cities and apps that allow you to get anything in 30 minutes or less. We want to continue working with local brick and mortar stores, and we only succeed if we help them grow and succeed with us.

I think having role models to look up to is very important to improve diversity in European tech. The role models from 20 years ago were not a very diverse group of people, so I hope this changes for future generations. Technology is such an important part of our lives that we can't afford for it to be a place dominated by homogenous groups; it has to represent the world around us. But culture doesn't change in a year - it changes through role models when given enough time.

My advice to young founders would be to ignore the noise and focus on the customer and the value you’re building for them. No one ever built a great company by focusing on every competitor or every new thing that investors were excited about. You must pick your battles. Competition is a fact of nature if the opportunity is big enough, and you must get comfortable with that and learn how to succeed and thrive no matter how competitive it is.

The events of 2020 were a roller-coaster. Because we’re very country-specific in our approach, it’s been 23 roller-coasters, not just one. We’d always anticipated that delivery would go beyond restaurants, so the pandemic only accelerated the shift to other offerings, like groceries, pharmacy goods and electronics. Looking ahead, we’re going to continue expanding beyond the restaurant. We’re seeing a fundamental shift to online, but I don’t think the future of retail lies in a remote Amazon warehouse and a 24-hour delivery service. The future of retail is a distributed network of small warehouses within cities and apps that allow you to get anything in 30 minutes or less. We want to continue working with local brick and mortar stores, and we only succeed if we help them grow and succeed with us.

I think having role models to look up to is very important to improve diversity in European tech. The role models from 20 years ago were not a very diverse group of people, so I hope this changes for future generations. Technology is such an important part of our lives that we can't afford for it to be a place dominated by homogenous groups; it has to represent the world around us. But culture doesn't change in a year - it changes through role models when given enough time.

My advice to young founders would be to ignore the noise and focus on the customer and the value you’re building for them. No one ever built a great company by focusing on every competitor or every new thing that investors were excited about. You must pick your battles. Competition is a fact of nature if the opportunity is big enough, and you must get comfortable with that and learn how to succeed and thrive no matter how competitive it is.

2021

unicorn

unicorn

Crypto

on

cusp of

mainstream adoption

A nascent but dynamic European

ecosystem, with clear category leaders

There have been notable investments in blockchain

and

crypto

start-ups this year

The ecosystem is maturing and beginning to show a path towards strong product market fit, and real-life applications

The ecosystem is maturing and beginning to show a path towards strong product market fit, and real-life applications

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, Flexera

State of the Cloud (2020), press releases, and GP Bullhound analysis

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Note: Cut-off date for inclusion in report 31 March 2021; valuations correct as of 12 May 2021

Split of new Fintech

billion-dollar

companies

by

combined valuation

Tipping

point

Institutional adoption of crypto

gathers pace,

but challenges remain

but challenges remain

The gradual adoption of Bitcoin

and cryptocurrencies by corporations and financial institutions signals a

broader acceptance within financial services that will require a new set of

products and services for support

Challenges remain to achieve mainstream adoption, but it is clear crypto is at a tipping point

Challenges remain to achieve mainstream adoption, but it is clear crypto is at a tipping point

Corporates positively endorsing

use

of cryptocurrencies

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase,

Statista, Coinmarketcap, Press Releases, and GP

Bullhound analysis

Note: Market data as of 20 May 2021

Note: Market data as of 20 May 2021

Risks

and obstacles to mainstream adoption

image

energy consumption

regulation

Apprehension due to history of

cryptocurrency theft and

black-market association

black-market association

Energy used to mine and maintain

blockchain could hamper global climate change

Regulation needed to keep investors safe

and the market orderly

- TECH COMPANIES ONLY, WITH A BIAS TOWARDS INTERNET / SOFTWARE (CLEANTECH AND BIOTECH EXCLUDED)

- HEADQUARTERED IN EUROPE (INCL. ISRAEL)

- FOUNDED IN 2000 OR LATER

- RAISED $20M OR EV OF $400M+ FROM 2015 ONWARDS

- EXCEPTIONS MADE FOR FAST-GROWING COMPANIES

CRITERIA

DATA-DRIVEN

- SCALE (1/3): CAPITAL RAISED OVER THE LAST FOUR YEARS AND HEADCOUNT AS OF MARCH 2021

- VELOCITY (1/3): GROWTH IN CAPITAL RAISED IN 2020 AND 2021 YTD VERSUS 2018 AND 2019; GROWTH IN HEADCOUNT IN MARCH 2018-2021

- SENTIMENT (1/3): CROWDSOURCED FROM THE EUROPEAN VC COMMUNITY AND GP BULLHOUND TEAM

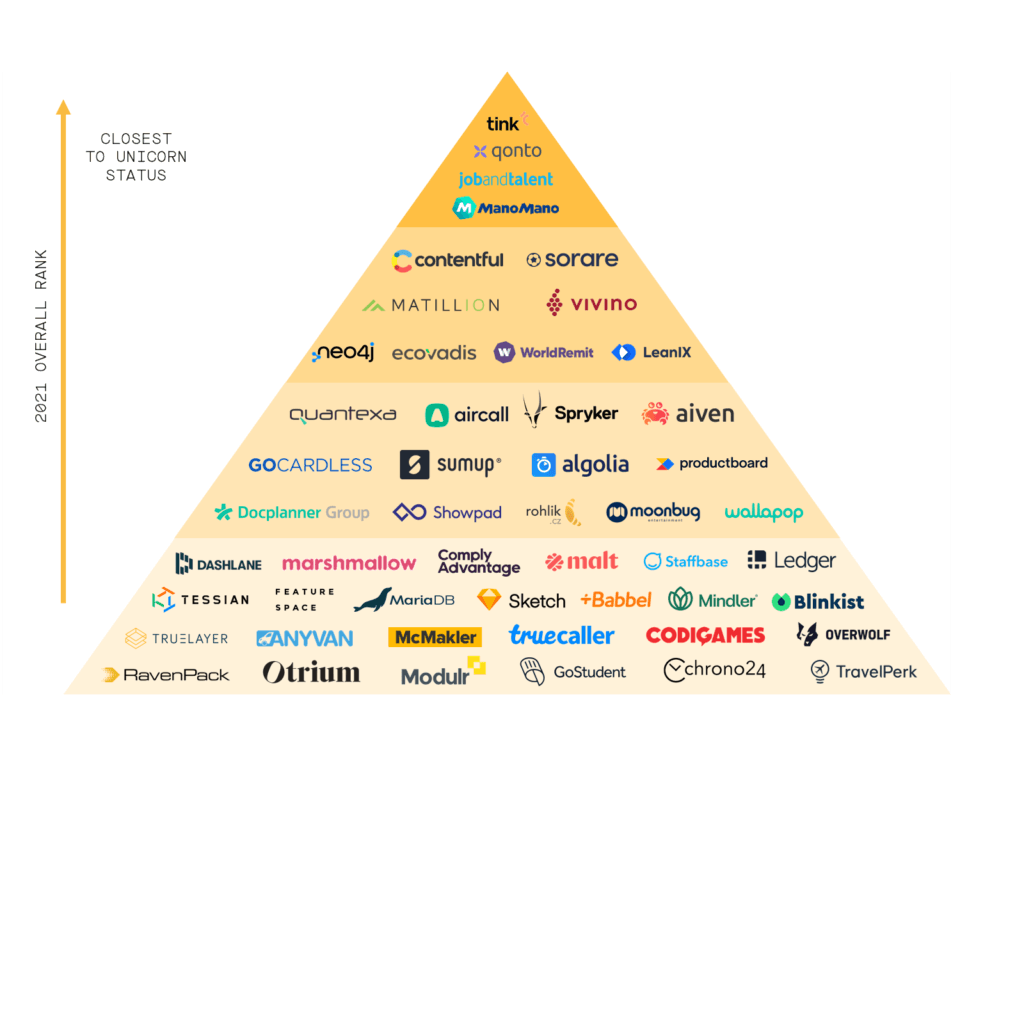

We analysed the performance and development of more than 1,000 start-ups since 2015 for our top 50 list of Contenders with the most potential to reach $1bn in the next two years

We show those demonstrating the greatest ambition and taking the largest risks, and look at the sectors and countries most likely to deliver the next European leaders

We show those demonstrating the greatest ambition and taking the largest risks, and look at the sectors and countries most likely to deliver the next European leaders

Start-ups nearing Unicorn status

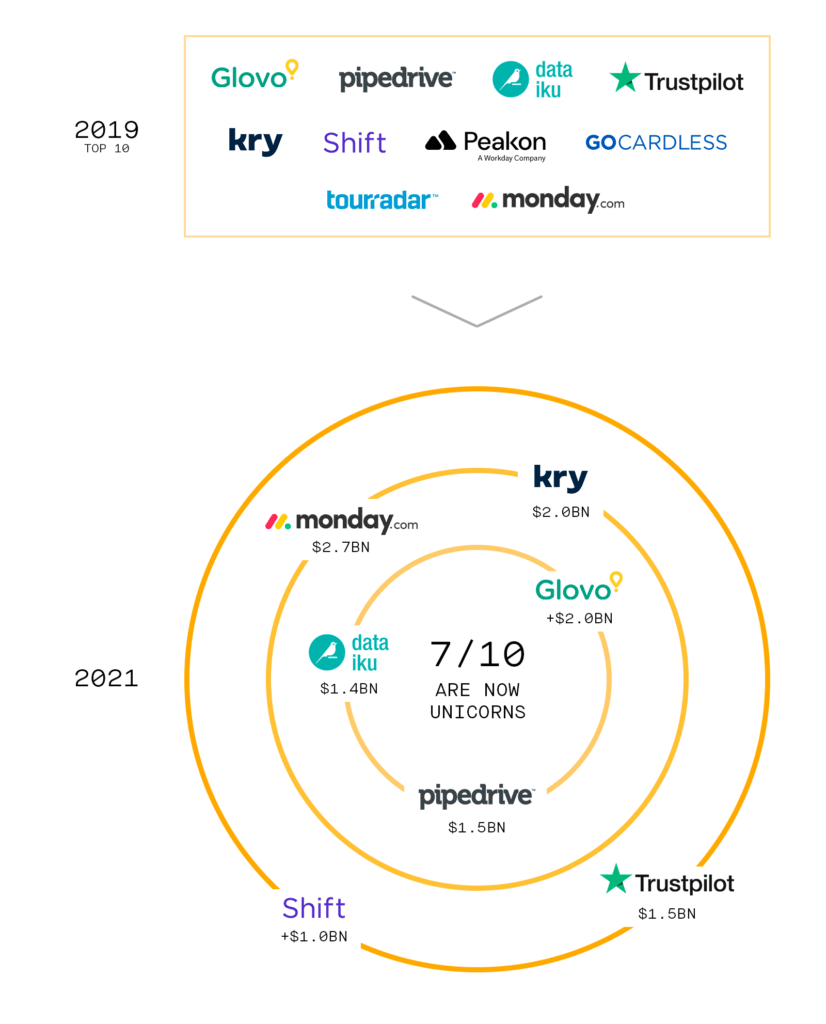

70% of our 2019

top 10 reached $1bn

top 10 reached $1bn

Many of our top Contenders in 2019 are Unicorns today or are

on the path to reaching the billion-dollar mark

Among this cohort are notable Enterprise Software companies, such as Monday.com and Pipedrive, and next-gen Marketplaces, such as Glovo and KRY

Among this cohort are notable Enterprise Software companies, such as Monday.com and Pipedrive, and next-gen Marketplaces, such as Glovo and KRY

what to watch

The next billion-dollar companies will likely continue to grow from a diverse spread of sectors

and geographies

But we expect Enterprise SaaS and Marketplaces to lead the charge

But we expect Enterprise SaaS and Marketplaces to lead the charge

Our formula for top 50 contenders

Europe’s

next

generation

Our

billion-dollar contenders

The UK, DACH, and France are likely to remain hotspots where future Unicorns find their feet

But keep an eye on the Nordics and Southern Europe as they amp up their Unicorn production

Where to look

How

did we do?

70% of the companies we ranked as

the most likely to become Unicorns reached over

a billion-dollar valuation in

the past two years

The 2019 top 10 contenders

Source: Company data, Capital IQ,

Mergermarket, press articles, and LinkedIn as of end-March 2021

Europe’s

most promising start-ups

The 2021 top 50 contenders

For our top 50 list of companies with the most potential to reach $1bn in the next two years, we analysed the performance and development of more than 1,000 start-ups since 2015

Source: Company data, Capital IQ, Mergermarket, press articles, and LinkedIn as of end-March 2021

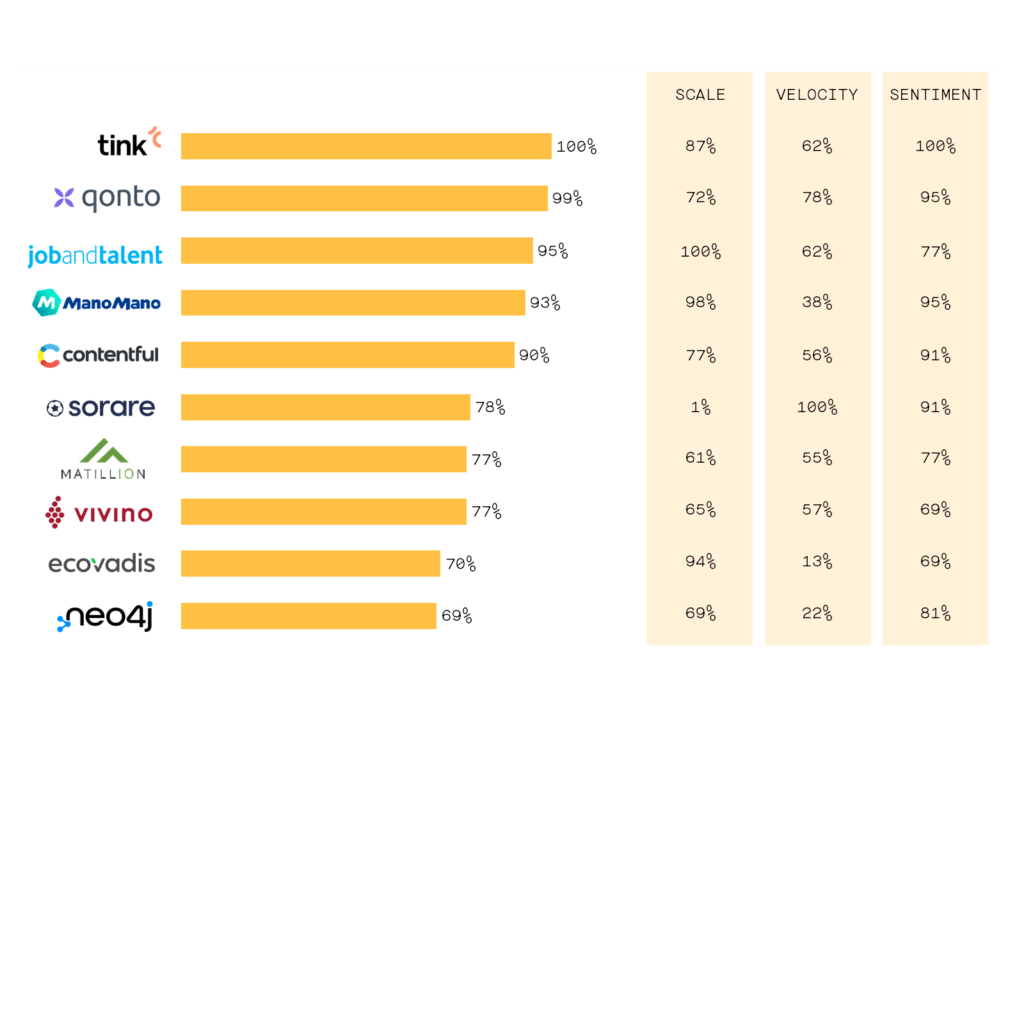

The

next European billion-dollar company

The top 10

From our ranking of Europe’s top

50 Contenders for reaching a billion-dollar valuation, we

highlight the top 10 European

start-ups

that

have the potential to become Unicorns in the

next two years

For each metric, scores for all companies are rebased as a percentage of the leading company at that metric (100%)

For each metric, scores for all companies are rebased as a percentage of the leading company at that metric (100%)

Source: Company data, Capital IQ,

Mergermarket, press articles, LinkedIn, as of end-March 2021

The

next European billion-dollar company

By sector and geography

Ranking the top 50 Contenders

by sector and geography, Enterprise SaaS, Fintech, and Marketplaces, as well as the UK, DACH, France, and the Nordics are most likely to produce the next

billion-dollar companies

Source: Company data, Capital IQ, Mergermarket, press articles, and LinkedIn, as of end-March 2021

Contenders

"More than 80% of the world’s data is unstructured and

until recently, technology did not really support doing much except storing it

or cherry-picking some of it for analysis.

We at RavenPack believe the most valuable insights are hidden in these large oceans of data and have developed AI systems that understand relationships between entities, identify elusive patterns, and are capable of forecasting market-moving events. Our analytics unleash a wealth of actionable information that translates into higher profits, reduced costs, and less risk for our customers.

We are proud to serve over 70% of the top-performing financial institutions globally and our impact is growing with diverse corporate and government institutions embracing our big data analytics. There is no stopping us now – the data revolution has only just begun!"

We at RavenPack believe the most valuable insights are hidden in these large oceans of data and have developed AI systems that understand relationships between entities, identify elusive patterns, and are capable of forecasting market-moving events. Our analytics unleash a wealth of actionable information that translates into higher profits, reduced costs, and less risk for our customers.

We are proud to serve over 70% of the top-performing financial institutions globally and our impact is growing with diverse corporate and government institutions embracing our big data analytics. There is no stopping us now – the data revolution has only just begun!"

“We started Overwolf in 2010, building apps for the games we

played. Our original vision was to build a Swiss Army Knife-type software, with

all the features we were missing while playing games, but we soon realised we

were onto something much bigger. We pivoted to build an open framework enabling

hundreds of thousands of other creators to realise their visions, make games

better, and ultimately create a brand new career category: the in-game creator.

Today, Overwolf is the guild for in-game creators. With over 30,000 creators, 90,000 mods and add-ons, and 18m monthly active users, Overwolf is the all-in-one platform that enables in-game creators to create, distribute, and monetise in-game apps and mods. We are on a mission to unite the in-game creator community and empower them to make a living doing what they love – developing truly awesome gaming creations.

After 300%+ growth each year in the last two years, we launched CurseForge Core, a User Generated Content (UGC) as a service platform. We are excited for the future of the games industry as we lay the groundwork for a new era of game creation that will benefit game publishers, the in-game creator community, and gamers.”

Today, Overwolf is the guild for in-game creators. With over 30,000 creators, 90,000 mods and add-ons, and 18m monthly active users, Overwolf is the all-in-one platform that enables in-game creators to create, distribute, and monetise in-game apps and mods. We are on a mission to unite the in-game creator community and empower them to make a living doing what they love – developing truly awesome gaming creations.

After 300%+ growth each year in the last two years, we launched CurseForge Core, a User Generated Content (UGC) as a service platform. We are excited for the future of the games industry as we lay the groundwork for a new era of game creation that will benefit game publishers, the in-game creator community, and gamers.”

"When the UK announced its Open Banking initiative in

2016, Luca Martinetti and I decided to move to London and found TrueLayer.

For decades, traditional banks have monopolised financial services. Building and maintaining new financial services is costly and time-consuming, involving multiple integrations and complex regulatory challenges. Meanwhile, people still struggle to open bank accounts, access credit, and manage their money. The data required to change this exists but is locked in incumbent systems, collecting dust.

We saw an opportunity to make the financial system work for everyone – by exposing complex services as simple code. Our mission is to open up finance, putting fintech at people’s fingertips, so that innovators in every industry can build better financial experiences for their customers.

Today we are a global open banking platform. We work with fast-growing companies across different sectors, from start-ups to enterprises, enabling them to integrate financial data and payments into any website or app. We process 50%+ of the open banking volume in the UK, Ireland, and Spain, and we're just getting started..."

For decades, traditional banks have monopolised financial services. Building and maintaining new financial services is costly and time-consuming, involving multiple integrations and complex regulatory challenges. Meanwhile, people still struggle to open bank accounts, access credit, and manage their money. The data required to change this exists but is locked in incumbent systems, collecting dust.

We saw an opportunity to make the financial system work for everyone – by exposing complex services as simple code. Our mission is to open up finance, putting fintech at people’s fingertips, so that innovators in every industry can build better financial experiences for their customers.

Today we are a global open banking platform. We work with fast-growing companies across different sectors, from start-ups to enterprises, enabling them to integrate financial data and payments into any website or app. We process 50%+ of the open banking volume in the UK, Ireland, and Spain, and we're just getting started..."

Expert view

OVERWOLF

URI MARCHAND, Co-Founder & CEO

URI MARCHAND, Co-Founder & CEO

truelayer

FRANCESCO SIMONESCHI,

Co-Founder & CEO

FRANCESCO SIMONESCHI,

Co-Founder & CEO

RAVENPACK

ARMANDO GONZALEZ, Co-Founder & CEO

ARMANDO GONZALEZ, Co-Founder & CEO

2021

contender

contender

2021

contender

contender

2021

contender

contender

Blizzard of activity in 2021

European

leaders no longer constrained by access to capital

Mega-rounds

($50m+) firmly here to stay

A record $14.9bn raised on aggregate in Q1 across 79 transactions

The blistering start to the year marked almost one year’s worth of historical activity versus pre-pandemic 2019 – contributing to overall growth and long-term prospects for the ecosystem

The blistering start to the year marked almost one year’s worth of historical activity versus pre-pandemic 2019 – contributing to overall growth and long-term prospects for the ecosystem

The swell in activity reflects

the boom in private tech companies

This is in part spill-over from public markets activity with funds wanting to gain access to high-growth technology companies earlier in their lifecycle

This is in part spill-over from public markets activity with funds wanting to gain access to high-growth technology companies earlier in their lifecycle

Dealmaking

surges amid pandemic

Enterprise

Software and Fintech lead, Marketplaces returns

Over

$32bn has been invested across 221 transactions in 2020 and 2021 YTD

The focus is on Enterprise Software and Fintech, but the return of the consumer brought Marketplaces and E-commerce back in favour

The focus is on Enterprise Software and Fintech, but the return of the consumer brought Marketplaces and E-commerce back in favour

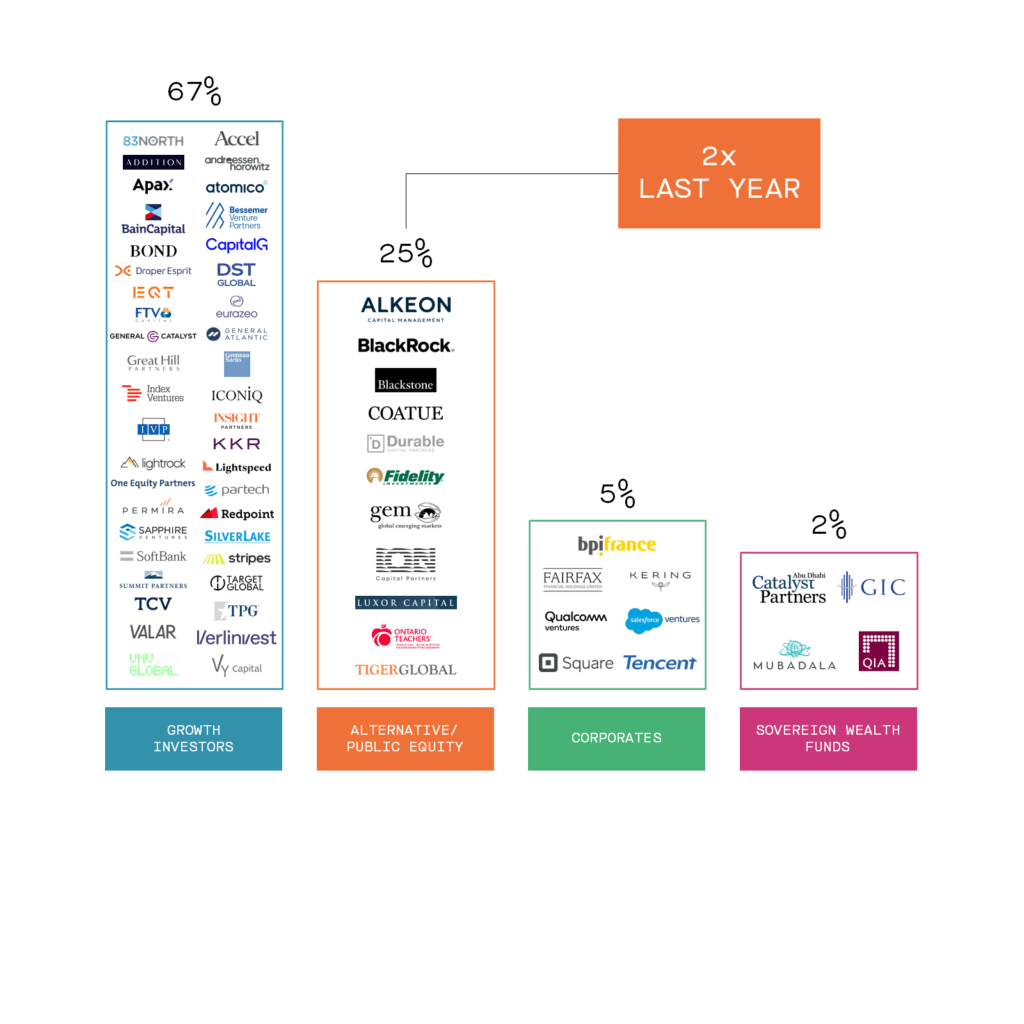

Availability

of capital no longer A constraint

With

more availability of capital, multiple established pools of capital are

investing in European tech leaders

Growth investors are most active - a staple of the ecosystem - but alternative / public equity investors have notably increased

Growth investors are most active - a staple of the ecosystem - but alternative / public equity investors have notably increased

Boom in mega-rounds

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Investments greater than $50m between 1 January 2017 and 31 March 2021

Note: Investments greater than $50m between 1 January 2017 and 31 March 2021

$14.9bn raised in Q1 alone

Fundraising has hit new heights, with the blistering start to 2021 seeing almost one year's worth of historical activity in Q1

The number and the aggregate value of large late-stage fundraises of $100m+ have increased significantly

The number and the aggregate value of large late-stage fundraises of $100m+ have increased significantly

Mega-rounds of $50m+

Where

investors are putting their money

$32bn invested in 2020 and 2021

YTD across 221 transactions

There is a concentration of

investment in Enterprise Software, Fintech and Marketplaces companies

Capital is no longer a constraint, with mega-rounds more prevalent than ever across multiple sectors

Capital is no longer a constraint, with mega-rounds more prevalent than ever across multiple sectors

Sector analysis of mega-rounds, by aggregate raised

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Investments greater than $50m between 1 January 2020 and 31 March 2021; Chart is based on the value raised, Selected company logos only; this is not an exhaustive list of all transactions

Note: Investments greater than $50m between 1 January 2020 and 31 March 2021; Chart is based on the value raised, Selected company logos only; this is not an exhaustive list of all transactions

Public

equity funds flexing their muscle

c.25% of mega-rounds, up 2x from last year’s report

Europe is attracting investments

from a diverse mix of investors as access to capital is no longer a constraint

There has been a notable increase in alternative / public equity investors backing European tech in the last 12 months

There has been a notable increase in alternative / public equity investors backing European tech in the last 12 months

Source: Capital IQ, Mergermarket, Pitchbook, Crunchbase, press

releases, and GP Bullhound analysis

Note: Investments greater than $50m between 1 April 2020 and 31 March 2021, where lead investors are publicly disclosed – investment total divided equally between identified lead investors; Selected investor logos only; this is not an exhaustive list of all investors

Note: Investments greater than $50m between 1 April 2020 and 31 March 2021, where lead investors are publicly disclosed – investment total divided equally between identified lead investors; Selected investor logos only; this is not an exhaustive list of all investors

Anne

Boden

Starling Bank

Before

I set out to rebuild Britain’s banking system, I spent 30 years in the

industry, trying to fix banks. As COO of Allied Irish Banks, I saw technology

was changing and things were moving fast in other industries, but banking was

still focused on trying to repair the problems of the past.

I decided to go travelling for inspiration. I spent time with bank CEOs in other countries talking about the problems they were facing. They were all telling me the same story about refurbishing branches, moving things to mobile, and big transformation projects. But when I spent time in Silicon Valley, I realised how refreshing nimble tech start-ups were and how ambitious their growth plans were.

I didn’t think that I could be the disruptor building a challenger bank, until finally, I decided that, if someone was going to do it, who better than me? In 2014, I quit my job at AIB and started fundraising. But my plan was too audacious. I wanted a full banking license and to build the technology from scratch. I didn't want to just buy software; I wanted a different business model. Of course, nobody thought it could be done, and nobody thought that I could do it.

I wanted to build a world-beating platform – not a small company that could scale to test market perception. I wanted this product to support the biggest banks in the world and do all the things that held me back in my previous roles. But the difficulty is not in innovation – that’s not where the battle is won. The battle is the cost base. This is us against the big banks; we are doing everything they are but at lower costs, while giving consumers and companies great tools to do their business.

I decided to go travelling for inspiration. I spent time with bank CEOs in other countries talking about the problems they were facing. They were all telling me the same story about refurbishing branches, moving things to mobile, and big transformation projects. But when I spent time in Silicon Valley, I realised how refreshing nimble tech start-ups were and how ambitious their growth plans were.

I didn’t think that I could be the disruptor building a challenger bank, until finally, I decided that, if someone was going to do it, who better than me? In 2014, I quit my job at AIB and started fundraising. But my plan was too audacious. I wanted a full banking license and to build the technology from scratch. I didn't want to just buy software; I wanted a different business model. Of course, nobody thought it could be done, and nobody thought that I could do it.

I wanted to build a world-beating platform – not a small company that could scale to test market perception. I wanted this product to support the biggest banks in the world and do all the things that held me back in my previous roles. But the difficulty is not in innovation – that’s not where the battle is won. The battle is the cost base. This is us against the big banks; we are doing everything they are but at lower costs, while giving consumers and companies great tools to do their business.

Expert view

FOUNDER AND CEO

2021

unicorn

unicorn

We need to encourage entrepreneurialism to create the next generation of founders, then we need to have more female founders

Starling is known for being trustworthy, not for being young, flashy or frivolous. We’ve built our tech base to be API-enabled from day one so that we can plug into other propositions – we wanted to allow customers to benefit from other products using a marketplace. It was important to make Starling the banking application and license behind other brands and we have successfully provided banking-as-a-service to large banks in Europe.

We will probably offer banking-as-a-service outside of the UK as well because we have other businesses wanting to embed our services within their offering. They have no intention of starting a bank or having a traditional partnership with one. They want to use their brand with our technology and banking license to go to market.

For the future, I think Starling is going to be a SaaS solution with a banking license, offering all financial services to our customers on a global basis. We became monthly profitable in October 2020 and our sights are set on an IPO in the coming years.

We’ve remained resilient during the pandemic but appreciate that the past year’s been very difficult for many. We've done c.£2bn worth of lending and have been there for our customers. The world’s gone through significant change and it’s great to see a big shift towards digital.

I had the luxury of having a commitment of £48m to start building Starling from an investor with a long-term horizon, but women have such difficulty raising money. But unless we encourage more women into the VC world and get diversity there, it's not going to improve things. We need to encourage entrepreneurialism to create the next generation of founders, then we need to have more female founders. I hope my journey inspires others – successful female entrepreneurs attract other successful women to start businesses.

We will probably offer banking-as-a-service outside of the UK as well because we have other businesses wanting to embed our services within their offering. They have no intention of starting a bank or having a traditional partnership with one. They want to use their brand with our technology and banking license to go to market.

For the future, I think Starling is going to be a SaaS solution with a banking license, offering all financial services to our customers on a global basis. We became monthly profitable in October 2020 and our sights are set on an IPO in the coming years.

We’ve remained resilient during the pandemic but appreciate that the past year’s been very difficult for many. We've done c.£2bn worth of lending and have been there for our customers. The world’s gone through significant change and it’s great to see a big shift towards digital.